What Can Your Rental Do For You?

Buying investment real estate is a great tool to diversify your investment portfolio. Having all your eggs (savings, retirement funds) in one basket is known to be problematic. Various avenues of savings should be part of your retirement strategy and a Rental Property or two can provide just that.

Rental properties purchased carefully, like we talked about in our blog- Building Your Real Estate Portfolio, can provide additional streams of income to you – Day 1. When you purchase a property that cashflows immediately you can either use that money as extra income or use those profits to pay down a mortgage if you have one. You can also put those profits into a savings account and use it as an unexpected expenses fund for that property as well.

Rental properties can also provide a nice income stream in retirement. With the right size portfolio of paid off properties you could be very comfortable. I was speaking with a golf buddy about her parents’ rental property purchased in their 40s. She shared that they had purchased a quad (4 units) and now that property provides most of their income for the month and they are well into their 80s now.

Willie, our in-house investment Guru here at Walters & Co. likes to see at least 6 properties in an investor’s portfolio with a good mix of condo/single family homes. He guides our 70+ investors from purchase to sale and everything in between. He can help with portfolio performance assessments as well. -Sorry, not sorry for the shameless plug-

If you think you would like to learn more about building your own investment portfolio or are curious about buying your first investment property please click on the link to schedule a chat with Willie or Lizz!

Do You Know How Your Home Is Insured?

One of the lessons from the Marshall Fire that has come to light is how people’s homes are insured. In speaking with our attorneys last week, they informed us that some people are not fully insured because they changed the name that is on their deed. Many people buy real estate in Trusts and LLC’s or buy them personally and transfer them to Trusts and LLC’s. When you do this, you need to remember to let your insurance provider know so that the home is covered by the policy. Call your insurance provider today to make sure your personal or investment property is named correctly and you are insured!

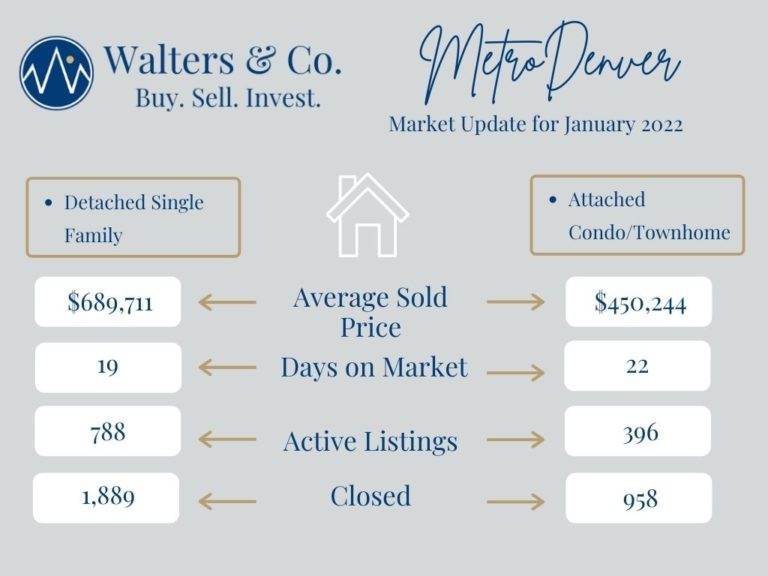

Denver Market Update

- January started like a Rocket with more competing offers, appraisal gap language, inspection waivers, free post-closing occupancy agreements offered, earnest money going hard and every other trick buyers, with help from their agents can think of. When they find the right one, they need to put it ALL on the line because it may be another month or so before they find another home that they like. The worry for buyers right now is higher interest rates and the expected 10% appreciation gain likely to happen by years end.

- Our market has escalated in anticipation of an interest rate hike, that coupled with another month end inventory (or lack there of) number (almost 50% lower than this time last year) is seeing homes go under contract at 10- 25% over asking price. I have clients out there and trust me we see it every day.

- Is cash always King? Some positive news for buyers is that a local title company, First Integrity reported that Cash deals crash 5.7% more often than financed purchases indicating that cash isn’t always King.

- New Build News: To counter rapid growth in prices and reduce risk, new home builders are selling more spec inventory rather than dirt starts. Additionally, builders are including language that would allow the builder to increase the base price within the first few months of a new contract.

- The Marshall Fire area are still seeing home sales move just as quickly as the rest of the market here in Denver. Last month there were 17 homes under contract that sold withing 2 days of being on the market.

- The average active listings number for January is 12,732

- The record high was recorded in 2008 for January of 24,550

- January 2022 set a new record with 1,184 active listings

- Historical average decrease from December to January is 5.3% this year’s decline was 19.84%

When we look into the Crystal Ball I think what we see is interest rates rising and demand for housing softening a little. Then soon there after inventory coming back on the market and interested rates going back down again fueling housing demand again. Not sure when we can count on this happening but possibly by the fall of 2022.

In conclusion, Buyers hold on!! As professionals we feel for you and are working hard to figure out ways to get your offers accepted without losing your first born. Lenders are also working hard to make your offers stronger with loans that can close in under 15 days. If we can answer any questions or if you would like to meet up to talk strategy please click the link below!

Village Invest: Judi’s House

Judi’s House is a non-profit based in Denver, Colorado that was founded in 2002 by former Broncos quarterback, Brian Griese and his wife, Dr. Brook Griese. Their inspiration for Judi’s House came from the sudden death of Brian’s mother, Judi, at the age of 12. Along his path to healing, Brian realized that he wanted to give back to children and young adults who were also grieving the loss of an important person in their lives.

Judi’s House is a community-based beareavement center for children and families with the vision that no child should be alone in grief. In order to achieve their vision they are committed to providing comprehensive grief care services for bereaved youth and families at Judi’s House as well as in school- and community-based settings throughout Metro Denver. These vital services are delivered at no cost to families thanks solely to philanthropic support.

They believe that supporting children grieving a death loss builds connection and coping that leads to healing. By investing in direct service, training, and research, we help whole families adjust to loss and prepare for future challenges. Check out a few impact stories from Judi’s House below:

Joni Jackson-Malavasi:

After losing her husband in a climbing accident, she turned to Judi’s House in search of way to support her young children. After processing her grief and the loss of her husband, Joni returned to Judi’s House as a volunteer.

Tracy Edwards Konkol and Steven Konkol:

The Edwards Konkol family found Judi’s House after losing their 14-year-old son to suicide in 2014. They were looking for ways to support their then 12-year-old daughter through the tragic loss of her brother. Tracy says, “we had no idea how to assist her with her grief or how to process our trauma”. The Edwards Konkol family continues to support Judi’s House through monthly giving.

Lisa Dean:

Lisa found Judi’s House after experiencing the tragic loss of her husband, Bart, in 2009. At the time her son Oliver was only 5 1/2 years old. Lisa says “Judi’s House provide support, tools and hope during these very challenging times. I wish it existed when I was a teenager and experienced the death of my mother. Oliver and I learned that we are not alone in our grief and that grief is not about letting go, but about holding on in a different way”. Since attending their own programs at Judi’s House, Lisa and Oliver continue their support by volunteering.

Amanda Howard:

Amanda is a Nourishment Provider and Emerging Leaders Co-Chair for Judi’s House. She says that she volunteers in honor of her late sister. “When I was 10, my younger sister died in an accident. It wasn’t until my 30’s that I started digging into how her death affected my family and me. I have come to realize that unprocessed grief continues to manifest itself in different ways. My family would have benefited from a resource like Judi’s House, to process our grief, find healing, and connect with other grieving children”.

Donate to Judi’s House

Denver February Happenings

Are you looking for a reason to get out of the house these days? Yes? Then you are in the perfect place! Here is our list of all the Denver must-do’s for the month of February!

Steamboat Winter Carnival:

February 9th-13th

This five-day cold weather affair covers everything from horse-pulled skiers to a torched run down from mid-mountain. The Winter Carnival parties are from Wednesday to Sunday!

Colorado Pond Hockey Tournament:

February 18th-20th

Are you a closet hockey star? This might be for you! Register now for the Pabst Colorado Pond Hockey Tournament hosted on Lake Dillon in Silverthorne, Colorado. Bring loved ones along so they can cheer you on from the sidelines!

Manitou Springs Carnivale & Mumbo Jumbo Gumbo Cook-Off:

February 26th

Celebrate Mardi Gras with delicious gumbo in the lovely Manitou Springs and a wonderful Carnivale festival. Top home and pro chefs alike will compete in the 25th annual Mumbo Jumbo Gumbo Cook-Off.

Winter Wonder Grass:

February 25th-27th

Just when you think Colorado can’t get any cooler, you realize they have winter music festivals! WinterWonderGrass will spoil you with cool music and a cold beer! Come enjoy the best in bluegrass, Americana and roots music!

Sunrise Vinyasa Yoga @ Botanic Gardens:

February 1, 3, 8, 10, 15, 17, 22 & 24th

Denver Botanic Gardens is known for hosting the always stunning, Blossoms of Light, but did you know that they had sunrise yoga?! Come check it out along with a beautiful Colorado Sunrise! Registration is required, you can find it by clicking here.

Colorado Avalanche Home Game:

February 1, 10, 15, 25th

Grab the family and head to the Ball Arena to cheer on your Colorado Avalanche! There are 4 home games in the month of February. Check out their full schedule and shop tickets here!

Celebrate Black History Month In Denver

February 25, 2022

This exhibit portrays artist Verline “Mijiza” Geaither’s personal interpretation of the experiences of many black men, women and children who live and have lived in the United States of America.The Culture Museum

February 1-27, 2022: Fri-Sun

The historic Five Points is home to a new immersive pop-up art museum and selfie exhibition celebrating Black Girl Magic! The new experience is curated by Museum for Black Girls founder Charlie Billingsley.Organic Tarot: Works by Tya Alisa Anthony

Through April 3, 2022

Interdisciplinary artist and curator Tya Alisa Anthony combines archival photos with botanical imagery to illuminate and reframe the personal stories of Depression-era black sharecroppers and reimagine them as icons of divine and mystical power.Turn The Page with Colorado Matters: All That Is Secret

February 8, 2022

History and mystery come together in Colorado author Patricia Raybon’s new novel “All That Is Secret”, set in Denver when the Ku Klux Klan ruled the city. Raybon’s main character, Professor Annalee Spain, comes home to solve her father’s murder. Family and faith drive the young black theologian to follow in the footsteps of her literary idol: Sherlock Holmes. This is the inaugural book in Raybon’s new Annalee Spain mystery series. Grab a copy of “All That Is Secret” and join Colorado Matters to meet Raybon in this virtual event!

Demystifying the Black Panther Party and Black Lives Matter Organizations

February 19, 2022

Join Senior Librarian of the Blair-Caldwell African American Research Library, Jameka Lewis, as she unpacks the historical and contemporary social climates that birthed the existence of these very unique, largely demonized and often misunderstood organizations. Learn more about the mission and activist that transformed grassroots concepts that inspired global change agencies.

In the Upper Room

February 11-March 13, 2022

Loyalty, spirituality and colorism are all at play in this dramatic dark comedy based on the real family history of playwright and novelist Beaufield Berry. The Berrys are a multi-generational black family living under one roof in the 1970s. Their lives orbit around Rose, a strong-willed matriarch whose superstitions and secrets drive her relatives nuts. Fed up, the aunties, in-laws and granddaughters of the household make their own plans to break away so they can finally live in peace. But by standing their ground, they may lose what has held them together all along.

Purnell Steen & the Five Points Ambassadors

February 24, 2022

Purnell and the Five Points Ambassadors (also known as LeJazz Machine) is a band dedicated to playing and preserving the music of Denver’s legendary Five Points neighborhood. For their annual show in celebration of Black History Month, they will definitely swing and sway the Five Points Way, and, ever the storyteller, Purnell will share the histories of Black artists who have worked and played in Five Points.

Black Voices of Dance

February 24-27, 2022

Boulder Ballet presents Black Voices of Dance, an evening of dance highlighting the nation’s most vibrant Black voices in the field. Three world premieres celebrate the work of some of today’s prestigious Black choreographers, including Gregory Dawson, Sidra Bell, Amy Hall Garner and Boulder Ballet’s own Lance Hardin in an evening of original works sure to transcend.

Buffalo Soldiers: The Forgotten Black Army in the West

February 26, 2022

Learn more about the largely unknown history of African American army regiments, nicknamed the Buffalo Soldiers. Members of the Buffalo Soldiers of the American West organization will bring these individuals to life with stories, historically accurate costumes and artifacts. The presentation will include a special dedication to Cathay Williams, the only woman to serve in the US Army as a Buffalo Soldier.

Free Day- Denver Museum of Nature & Science

February 27, 2022

Head over to the museum to celebrate Black Science Day! (for free)

4 Rental Properties to Avoid Investing In:

When Building Your Real Estate Portfolio

Buying Your Dream Home:

When shopping for a rental property, you are shopping for an investment. It’s important to remember that you are not buying the home of your dreams, you are buying a property that will make money for you. Don’t get tricked by unneeded extras while missing on major defects. For example, buying a rental that’s more damaged than it may first appear because you are blinded by a beautiful fireplace or an amazing view from the front window. Long story short, do your best to maintain objectivity throughout the process and don’t overspend before you even get your first tenant!

Buying a Vacation Home:

While there are potentially many great things that can come from owning a rental property in a vacation area, plenty of drawbacks come along with them. At the top of the pros list, you’re buying a VACATION home. Not only could it be a lucrative investment from renting it out to tourists during the busy vacation season, it can be a nice place for some R&R for you and your loved ones. That being said, you may make more money from high turnover (a new tenant every couple of weeks) but you’ll also spend a lot more money on insurance, upkeep, property maintenance and even cleaning bills. You may also experience a lot more vacancy during the slower vacation months. For example, wintertime at the beach! One more thing to think about before buying a rental property in a vacation area is property management costs. If you are an investor looking to pawn off the landlord responsibilities of owning an investment property, you will be unpleasantly surprised by the inflated costs of hiring a property management company to run your vacation home.

Buying a Rental in a Declining Market:

If you’re looking into buying a rental property, we know you’ve heard this before: “location, location, location!” So, you’re probably wondering, how do I know if I’m buying a property in the right location? Well, to answer that question you must know the differences between a growth versus declining market. In short, a growth market is one that has a proven trend of growth. Or in other words, the population continues to increase. This is generally due to plenty of job opportunities. If a market continuously offers new job opportunities, people will continue to live and move there. Look for cities and neighborhoods that are home to several big industries. This way, if something happens to one of these industries, causing job loss, there are still several other industries providing opportunity. Another notable factor that effects population growth is desirability. There should be something about a city or neighborhood that makes people want to live there! Think weather, outdoor activities, restaurants, etc. This would be an example of the kind of market you WANT to buy in. On the flip side, a declining market has people moving away due to loss of jobs and opportunity. We often see the very things that make a market desirable like restaurants, shopping etcetera leave those areas as well. Investments in a declining market could possibly see homes decrease in value. You want to make sure you make cash-flow a priority to hedge against any appreciation loss. Buying in a growth market early is your best bet but if you decide a declining market purchase is for you make sure you do your research before investing.

Buying Outside of Your Budget:

Why is buying a rental property out of your budget a bad idea if it has the potential to make you a lot of money? A common rookie mistake made when purchasing a property is assuming that the down payment is all you need. In reality, when you purchase a rental property, you may experience some unforeseen costs at some point. There are a lot of potential costs that come along with owning a rental property, but for cash-flow purposes, let’s just focus on the recurring expenses. These can include, but aren’t necessarily limited to: mortgage payments, property taxes, hazard insurance, utilities, maintenance and even pest control. While owning rental properties can be very lucrative, it’s not enough to simply subtract your operating expenses from your income. That would assume that your property will never be vacant and you will never have to pay for any upkeep or maintenance. The best properties are maintained and updated from time to time. You should also be prepared financially, always, for some vacancy. There’s no way to predict these situations with 100% accuracy without a crystal ball, so it’s important to set aside a portion of the rent you collect to cover them when they happen. So, don’t spend more than your budget allows and expect the unexpected!

Do you have more questions about investing? Contact Us!

Building Your Real Estate Portfolio:

5 Mistakes People Make When Buying a Rental Property

1) Investing Based on Linear Appreciation

People often mistakenly invest in a rental property based on the idea that it will have a linear appreciation or gain in value in the coming years. In our current market we are starting to see more and more investors use this strategy. This is not a good idea. Property values can fluctuate from year to year and often do. An investor may need to unexpectedly sell their property and doing so in bad market can lead to a loss. Instead, investors should always invest based on the cash flow of the property (Willie’s Clients hear this all the time). This is why it’s important to have solid numbers at your fingertips during the vetting process and when buying a rental property. If you are interested in seeing these numbers for a property you own or are interested in buying, Contact Us!

2) Renovations and Rentals don’t usually mix

If you are going to purchase a property strictly for the purpose of renting it out, condition is important. The amount of money you will need to get it “rent-able” needs to be in your spreadsheet. Improvements to a rental property are very different than the ones you do to YOUR home. Beginner investors often under calculate what improvements cost, and that directly effects cash flow and sets the investment up to underperform. Set your eyes on properties that only need small cosmetic changes, if any, and remember that you will have to spend some money on your investment properties to keep them current so that you can compete for the best tenants.

3) Location, Location, Location still matters

Location should be the number one factor when starting your investment property search. This is even more important than the number of bedrooms, selling price, need for renovations, outdoor space, and parking. Don’t get us wrong, those are all important things too! However, you can potentially add square footage, update an older kitchen, or get a yard nicely landscaped. The location of your property is the one thing that you have no ability to change after you sign your purchase agreement. Here are 9 things to consider:

1. Distance from where you live

2. Schools

3. Public Transportation

4. Insurance

5. Walkability

6. Infrastructure

7. Type of Neighborhood – (HOA or no HOA, City or Suburbs etc)

8. Job Growth/Unemployment

9. Population Growth Potential

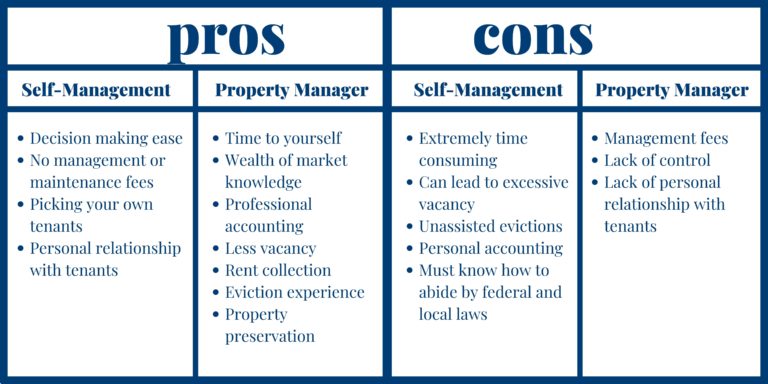

4) Deciding to Self-Manage or Hire it out

This topic always seems to be overlooked when buying a rental property. Knowing you’re your investment is going to be handled day in and day out is of incredible importance. Hiring a property manager can be a great option. After all, who wouldn’t like to know that their investment is being cared for around the clock? However, just like managing a property yourself, there are pros and cons of hiring someone to manage your rental property for you. We’ll run through some of the most common pros and cons of both strategies below. The decision should be made prior to you even beginning to look for property and should be accounted for in your numbers (spreadsheet).

5) Buying Too Many Properties

If you are a novice investor, it is important to avoid buying too many properties at one time. We have clients all the time that want to rush into the market and buy, buy, buy. One should consider buying one property initially to get a feel for the business. Buying a home is different than buying a rental property. Even if you have purchased your first home, the experience of doing so will be vastly different than buying property for investment purposes. In most cases, it is best to buy a single property initially. Doing so will give you a better idea of what is involved in the process. If possible, wait at least 6 months before buying any additional properties. This gives you time to understand all aspects of owning a rental property of your own. Allowing more time for this process allows you to work through any potential problems that may come up. Look at your first rental property as an opportunity to experience the business of property ownership and get a better understanding of it.

In conclusion, owning a rental property can be an excellent way of accomplishing many of your fiscal goals. Rental properties can provide a highly stable income that has tax advantages for the owner. Proper research and guidance is essential during the process. Investigate carefully and avoid these common mistakes. In turn, you may expect to have an investment that can help provide the basis for a comfortable financial future.

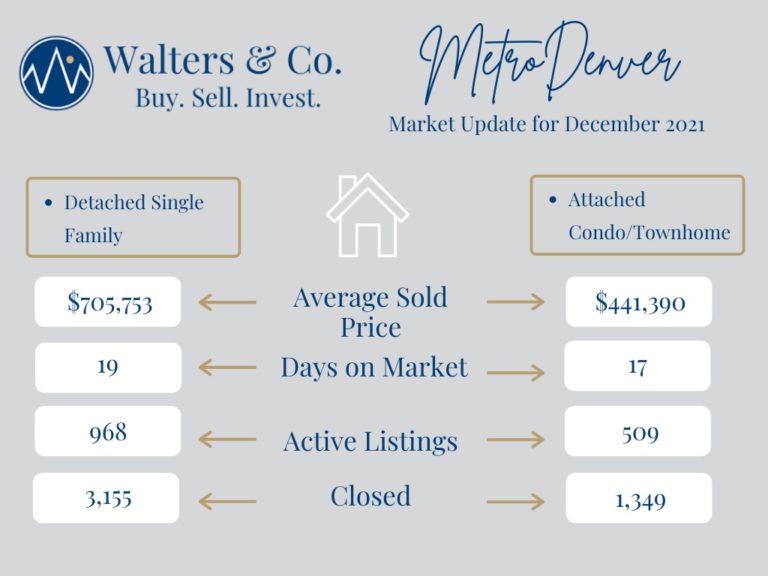

Record Setting December

The Good News:

We saw median prices appreciate 19.78 %. If you waited a year to buy the same house, the price would have gone from $455K a year ago to $545K today. In the real estate market, time is money- a lot of money. Based on the sustained demand for housing and lack of supply we think folks will see double-digit appreciation again in 2022. Since 1991, the Denver Metro area has appreciated around 7.5% a year. That is a solid number considering it has the housing crisis factored in as well.

Records Set for December and 2021!

We ended the year with another historic low supply number for Residential properties. December was left with 1,477 detached and attached homes available For Sale. Since 1991, the Denver Metro area has appreciated around 7.5% a year. The average active number of listings for December is 12,652 (1985-2020). The highest number of listings left available at the end of December was 24,603 in 2007.

The Next Big Question for Real Estate In 2022?

Interest rates! Interest rates will be our variable in 2022! With fears of inflation and few purchases of mortgage-backed securities and treasuries by the Federal Reserve rates jumped by 0.25% between December 21, 2021 and January 3, 2022. They are expected to land in the high 3% to low 4% range by mid year. It is not clear what effect volatile interest rates will have on the Real Estate market. What we do know, is that it will have an effect on Buyers’ mindsets and we will just have to wait see how much more uncertainty they will tolerate.

Our Crystal Ball:

The crystal ball says it is fair to assume that what was previously an outlier, the 2020 real estate market, is quickly becoming the norm. What can we do about the historic low supply and continued demand? Build more homes and more cities to change their policies surrounding building. That won’t be a fast fix and the other option is “The Buyers’ mindset”. If you are a buyer in this market, setting your mindset is incredibly important. You should be buying a home because you want all of benefits that homeownership have to offer- stability, equity building, aging in place and a sense of self. You may have to shop for homes that are below your budget knowing you will have to compete on almost every listing. The market is now a sport, you must be laced up and ready to roll at all times. The process can be stressful and complicated, working with a professional to help you navigate the current market is imperative. Intuition and insight cannot be quantified like commission fees but can make that subtle difference between homeownership and not.

Thanks to DMAR for the info

Our New Year’s Resolution: Village Invest

This week we would like to share our reason for the season! As many of you may have noticed, each Friday for the past month we have featured a charity on our page, and here’s why! We started Village Invest to ignite and support the idea of micro-giving. As our communities grow larger and larger it often feels like doing a little does not count;

“If you wait until you can do everything for everybody, instead of something for somebody, you’ll end up not doing anything for anybody” -Malcom Bane

We believe that even the littlest of efforts from large groups of people have the same effect as one large donor. We began Village Invest this past December by picking a charity each week that we believe spends the most of every dollar supporting the community. We don’t suggest giving to anything that we don’t give to as well and begin every week with our donation to excite others to give as well.

Our Business New Year’s Resolution this year is to expand on our “Village Invest Community: Micro Giving” campaign by picking a new charity every month for the year of 2022! As a small business who has been supported by this community we are so honored to be giving back in a small but consistent way. We are always willing to hear about any charities that might need some extra help so please don’t hesitate to reach out to us with your ideas.

We are excited to kick off 2022 with Village Invest #5, Warren Village!

About Warren Village:

With safe, consistent and affordable housing, families can break the cycle of poverty and achieve self-sufficiency. Warren Village offers 2-3 year transitional housing in 93 apartments accommodating single-parent families. 100% of single parents who reside or come to Warren Village were homeless or unstably housed. Warren Village’s apartment building is located in Denver’s Capitol Hill neighborhood, close walking distance to public transportation, stores, social service organizations, and a spacious city park. Each resident pays rent, based on their income, which ranges from $25 a month to 30% of their total income. Each resident must be committed to working toward specific personal and self-sufficiency goals.

Please join us in our micro-giving campaign or sharing your time with Warren Village. Donate here today! And

Happy New Year!

Village Invest: The American Red Cross

“Our purpose is to meet the immediate disaster-caused needs of individuals, families and communities”

This week many of us are looking forward to spending much needed time off work and time with loved ones at home. However, for those who were struck by the Tornado Outbreak of December 10th and 11th, the holiday season will be looking much different this year. That’s why for our fourth Village Invest Charity we have chosen the American Red Cross, with an emphasis on their Disaster Relief program. When a tornado devastates a city or a town like it did a few weeks ago, your donation helps the Red Cross provide shelter, food and comfort to families in need. Their relief services for these families also include distributing clean-up supplies like shovels, rakes and tarps, providing mental health support and counseling for families impacted by the storm and connecting loved ones that may have been separated after a storm.

The American Red Cross is a very special organization that was founded by a very special woman named Clara Barton. This week is a particularly special week for their organization because December 25, 2021 will mark the 200th anniversary of her birthday. It only makes sense that a woman who dedicated her entire life to the service of others was born on Christmas Day. A compassionate and tenacious trailblazer, she believed in serving others and built a legacy of service, innovation and hope when she founded the American Red Cross at age 59 and led the organization for more than 20 years.

Driven by a desire to be useful and help those in need, Clara sprang into action when the Civil War broke out, earning the nickname “Angel of the Battlefield” for her work to care for soldiers on the front lines. Exhausted after the war ended, she took a doctor’s medical advice to rest in Europe. This ended up being an experience that led her to establish the American Red Cross. Inspired by her experiences in Europe, Barton corresponded with Red Cross officials in Switzerland after her return to the United States. In May 1881, after leading a multi-year effort to gather support in the U.S. and establish the organization primarily with her own money, Clara founded the American Red Cross. The next year in 1882, the U.S. government signed the Treaty of Geneva — international humanitarian laws that, to this day, protect the sick and wounded during wartime and form national Red Cross and Red Crescent societies to deliver neutral aid voluntarily. Several years later in 1900, the American Red Cross received its first congressional charter. The most recent version of the charter, adopted in May 2007, restates the purpose of the organization, which includes giving relief to and serving as a medium of communication between members of the U.S. armed forces and their families, as well as providing national and international disaster relief and mitigation.

Clara’s vision of preventing and alleviating suffering continues today as ordinary people continue to advance her extraordinary legacy through the American Red Cross, touching millions of lives each year across the globe. For example, right now nearly 500 trained Red Cross disaster workers from all over the country remain on the ground in four states, providing shelter, meals, comfort and support after last week’s devastating tornadoes that left behind a heartbreaking trail of destruction. With such widespread damage and thousands of homes affected, families will need support for weeks to come and the Red Cross says they will be there for “as long as we are needed”. With the help of partners across four states, the Red Cross has served more than 28,000 meals and snacks, distributed more than 16,700 relief items, and provided more than 3,800 individual care contacts to help people with medical or disability needs as well as emotional and spiritual support during these challenging times. In Kentucky alone, they have served nearly 20,000 meals and snacks, distributed more than 8,000 relief items, and provided over 3,000 individual care contacts.

Join us in our mission to follow in the footsteps of Clara Barton and the American Red Cross whether it be through a financial donation for disaster relief, the gift of donating blood or volunteering your time. Every single contribution matters. Visit the American Red Cross today or Contact Us to see how you can help!

And from our family, to yours, Merry Christmas!

Thanks to the American Red Cross for the information

5 Things To Know About Homeowner’s Insurance

Here are five terms you should know when it comes to homeowner’s insurance!

ONE:

Deductible: A homeowners insurance deductible is the amount of money a homeowner must pay out of pocket before home insurance coverage kicks in. When the insurance company pays the claim, it will be for the total amount of the damage minus the amount of the deductible.

TWO:

Liability Coverage: The personal liability coverage within your homeowners policy provides coverage to pay for claims of bodily injury and property damage sustained by others for which you or covered residents of your household are legally responsible.this covers you against lawsuits for bodily injury/property damage that you (or family members) cause to other people.

THREE:

Replacement Cost: The value of most things depreciates over time, including your personal belongings and the materials used to build your home originally. A standard homeowner’s insurance policy will usually include replacement cost coverage for your dwelling and other structures, which means that the insurance company will pay for the covered structures to be rebuilt with materials at current costs up to your coverage limit. The same policy will usually only cover your personal belongings at actual cash value, or their current market value, including depreciation, unless you opt to pay more for an endorsement including replacement cost coverage for belongings.

FOUR:

Sub-Limits: A sublimit is part of, rather than in addition to, the limit that would otherwise apply to the loss. In other words, it places a maximum on the amount available to pay that type of loss, rather than providing additional coverage for that type of loss.

FIVE:

Riders: A rider is an insurance policy provision that adds benefits to or amends the terms of a basic insurance policy to provide additional coverage. Riders tailor insurance coverage to meet the needs of the policyholder. Riders come at an extra cost—on top of the premiums an insured party pays. like a mini insurance policy, riders give added protection to certain items that can get excluded/have low limits on your homeowner’s insurance policy.

Do you have any questions about any of these terms? Are you in need of some advice when it comes to insuring your home? Contact Us!

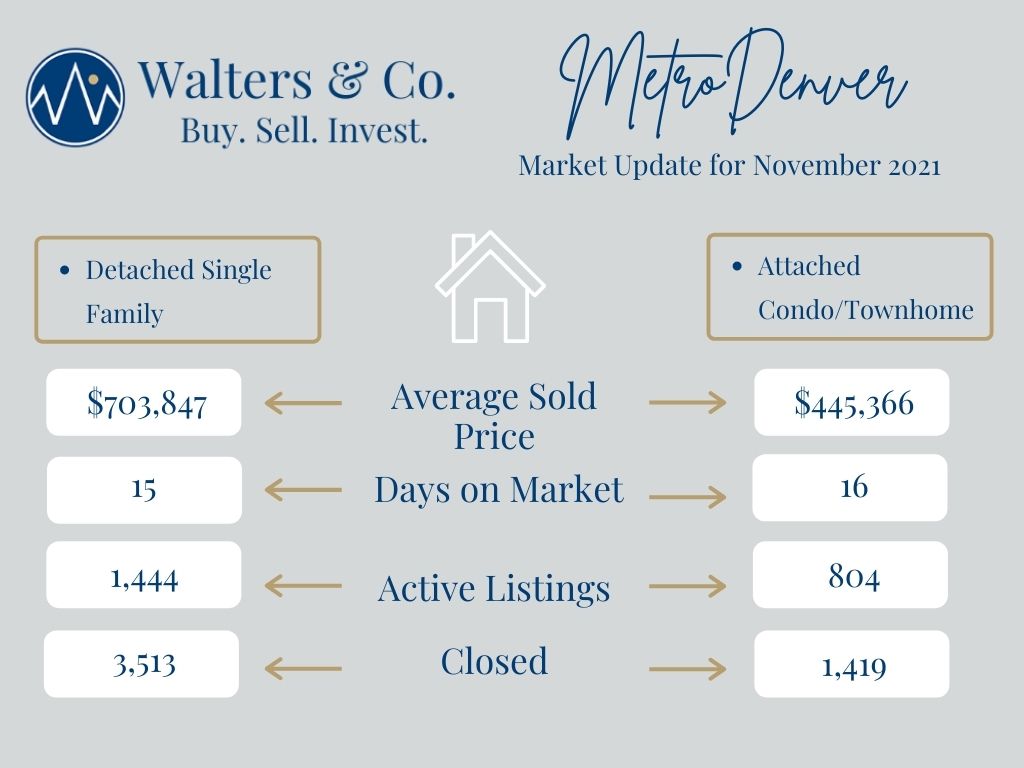

No Listings November

We suppose we could call this “No Listings November: with confidence because the historical average decrease in active listings from October to November has been 11.41%. However, this October to November we saw a decrease of 33.41%. This is the largest percentage decrease on record ever. Sizable percentage decreases have occurred in the last 10 years primarily due to our prolonged low inventory trends. We were left with just under 2,400 listings (both detached and attached homes) at the end of this November. Far less than November’s historical average for active listings, which is 14,000.

In other really good news, the 2022 conventional loan limit for Denver is now $647,200 and Denver Metro counties will see a new high balance loan limit of $684,250. If you are looking in Vail, Colorado for example, you can look forward to conventional loan limits of up to $862,500!

**If you would like to know more about what all this means please visit our Contact Us page and reach out to one of our agents, we would love to speak with you!**

Zillow recently cancelled 400 Zillow Offers contracts! Hundreds of sellers awaiting new builds will have to sell their homes another way after Zillow canceled contracts for closings set for late 2022. We want to let any homeowner stuck in a situation like this know that we are here for you and we are happy to help Sell Your Home immediately! We can almost guarantee a very quick sale with little to no hassle.

Our crystal ball says that the hot seller’s market will continue into 2022. If you are looking to buy, now is the time for several reasons. You should have less to compete with, interest rates remain low and conventional loan limits will be raised substantially at the beginning of next year. If you are thinking of selling, expect top dollar, especially if you price your property well. If you don’t, this market is still making sellers endure longer days on the market and significant price reductions.

In our opinion, when 2021 is over it will have seen the highest level of home sales in 15 years. The real estate market continues to change month over month. We saw increasing inventory in September and now by the end of November we are back to historical lows. Is it travel? The holidays? Could it be new Covid strains? We really don’t know, but we tell our clients that you really must consider home buying and selling a sport these days. You will have to suit up, go to practice every day and be ready for game time anytime. The exit of home buying giant, Zillow, does confirm that the market is too competitive and too volatile for the inexperienced. Zillow did their part to artificially inflate home prices and crash deals for unsuspecting consumers. Our hope, is that this exit will help to calm the waters so that we can get back to a true consumer supply and demand driven real estate market. Let us be the first to help you get back on your feet!

Denver December Happenings

Are you looking for some winter time fun this month to get yourself in the holiday spirit? Yes? Then you are in the perfect place!

Here is our list of all the Denver must-do’s for the month of December!

Downtown Denver Rink: Through February 20, 2021

Bundle up and bring the whole family or your close friends for some free ice skating this year. Located right in the heart of downtown, they will also be hosting special events!

Santa’s Flight Academy: Nov 12-Dec 24, 2021

Little ones can take a look and step inside a 22-foot tall sleigh and experience the magic of the season with snowfall. If they’re up to it, they can even have their photo taken with Santa! Make reservations by clicking on the link above!

Cherry Creek North Winter Wanderland: Nov 18, 2021- Dec 24, 2021

Check out Winter Wanderland and explore 16 sparkling blocks with more than a half-million lights and experience 8 twinkling displays all choreographed to music. This year, they have also included an interactive art installation called the “domino effect”, that will feature 120 brightly colored dominos. On Saturdays, December 4, 11 and 18 you can stop by for Saturday Night Lights, where you stroll beneath 600 illuminated trees while enjoying free treats and entertainment! Sign me up!

The Mile High Tree: Nov 19, 2021-Jan 8, 2022

Join in on the holiday fun when you go visit this festive Denver attraction. It’s a brilliantly lit 110-foot tall immersive art installation that provides dazzling lights accompanied by a music show!

Blossoms of Light: Nov 19, 2021- Jan 8, 2022

Denver Botanic Gardens is known for hosting the always stunning, Blossoms of Light, an annual family-friendly event that has become a tradition for people across Colorado. Come interact with incredible light displays plus sip warms drinks and snack on tasty treats as you stroll. Pre-purchased tickets are required.

Zoo Lights: Nov 22, 2021- Jan 2, 2022

Zoo Lights is celebrating its 30th Anniversary this year! This annual spectacle transforms the Denver Zoo into Colorado’s wildest wonderland. Don’t miss this years anniversary celebration which will feature over a million lights covering 80 acres!

Luminova Holidays: Nov 24, 2021- Jan 2, 2022

Making its Colorado debut, this family-friendly event brings larger-than-life holiday displays and immersive experiences for all to enjoy. It features more than 3 million lights, a 65-foot-tall Christmas tree, a 25-foot-tall snowman that never melts, a 200-foot-long candy cane tunnel, giant ornaments, a wall of lights, rides on limited Elitch Gardens attractions, train rides for the kids and interactive activities like a light-up hopscotch!

Trail of Lights: Nov 26, 2021- Jan 2, 2022

Stroll through the Colorado countryside along a winding path glistening with lights. This year, you will find a three-sided light tunnel, illuminated antique and model tractors, a children’s play area and warm holiday food and drink! Purchase tickets online by clicking on the above link!

Our Top Ten Thanksgiving Traditions

Every year on the last Thursday of November we all get the day off of work to spend time being thankful and grateful for what we have. This year we decided to share some of our favorite things to do on Thanksgiving! Maybe this year is the year you can start one of these traditions in your family!

ONE:

Write Thank You Cards

Get in touch with your gratitude by writing thank you cards to loved ones who have touched your life over the past year.

TWO:

Split The Wishbone

This funny tradition dates all the way back beyond the ancient Romans, stemming from the belief that birds were oracles and predicted the future. So, just in case they were right don’t forget to split the wishbone and make a wish!

THREE:

Take A Nap

A giant turkey feast has been know to make people pretty sleepy. So why not cuddle up for a little nap on the couch.

FOUR:

Make A Gratitude Jar

For a sentimental activity, make a gratitude jar. Give each guest a sheet of paper and pen and ask them to write down what they’re thankful for. Then collect each piece in the jar and read them aloud during dinner.

FIVE:

Volunteer Together

Lend a helping hand at a soup kitchen or food pantry to help others in need. It can be an important reminder to be grateful for all that we have for you and your family!

SIX:

Break Out The Old Family Recipes

Switch up your usual Thanksgiving dishing by breaking out old family recipes or having everyone bring something they remember eating as kids!

SEVEN:

Watch The Macy’s Thanksgiving Day Parade

No matter how old we get, watching the Macy’s Thanksgiving Day Parade never will! It’s a great way to kick off Turkey Day and kids will stay busy and love watching all of the floats go by!

EIGHT:

Run the Turkey Trot

If you live in Denver you can sign up for the annual Turkey Trot 5k with your friends and family, hosted in Washington Park!

NINE:

Donate Food

Try putting together a box of canned goods and non-perishables to donate to your local food pantry. Some cities also have Thanksgiving drives the donate turkeys and other holiday favorites to families in need!

TEN:

Watch Football

Sit back, relax and turn on the game with loved ones if you’re in the mood for a stress free Thanksgiving Day!

How to Winterize Your Home in a Weekend

Pride of ownership sells a home faster than most anything else, if you get in the habit of taking care of your home regularly count on an easier sale when it’s time to move. Part of that “Home Care” program should be readying your home for the cold weather. Here are some tips to help you get it done in a weekend!

Programmable Thermostat:

The US Department of Energy says you can save as much as 1% on your energy bill for every degree you lower your home’s temperature during the winter. Install a programmable thermostat now and save money by keeping the temp down when you’re not at home. If you are away from your home for an extended period of time make sure to leave the temperature no lower than 60 degrees to ensure your pipes don’t freeze.

Furnace Check:

Get this scheduled and change that Filter. Having your home’s furnace checked for efficiency every year will extend its life (and your savings account). Changing the filters on a regular basis is also good for your furnace and your air quality.

Gutter Cleaning:

To keep your home from possible leaks, remember to get those gutters clean and free of debris. Frozen leaves and debris can jam up those gutters so that water does not move freely. This is one of the primary causes of ceiling leaks inside a home.

Outdoor Sprinklers and Hoses:

Make sure that your sprinkler system has been totally drained. Remove outdoor hoses and store them in a dry place until spring has arrived.

Fireplace:

Be sure to clean out your fireplace gas or wood yearly. Also, if you don’t use your fireplace there is something called a fireplace balloon that can be installed to save on heating bills as well.

Fire/Carbon Monoxide Detectors:

Test and replace batteries in every detector you have. These small devices save lives if maintained regularly.

The weekend is here, time to get that Home Care habit going!

Meet Our Newest Team Member

As many of you know, Walters & Co. is a multi-generational family business, so it brings us great joy to announce the newest addition is another Walters! Mary Walters, started working with us in August of this year as a Transaction and Marketing Coordinator as well as our Team Administrator.

That is not all Mary does, however. Outside of her time here at Walters & Co. she is also a flight instructor out of Centennial Airport in Centennial, Colorado. She teaches people, often with little to no experience in airplanes, how to start from square one and go on to earn things like their Private, Instrument, and Commercial Pilot certificates.

Her journey to where she is now was a long winding road, though. Starting in 2018, when she was hired as a Flight Attendant for American Airlines. After almost two years of flying the friendly skies, she realized that airplanes may be the passion she was always searching for but being a Flight Attendant wasn’t the answer. So, she decided to take a leave of absence from her job with American Airlines and move back home to Denver to pursue a career as a pilot.

Mary also started from square one with no flying experience and spent 10 months in training at Centennial Airport. In those ten months she got all the certifications she dreamt of achieving! After that, there was a waiting period between school and being hired on as a flight instructor. That’s where we come in! During that waiting period we had an opening here at Walters & Co. and hired Mary on to work with us!

If you ask her what her favorite part of working here is, Mary will tell you that it’s coming in to the office every day and getting to see her parents and often her beloved family dog, Frito. She’ll go on to tell you that it’s more than that though. It’s getting to be a part of her family’s success story. It’s getting to see the company that started with an idea that her parents had eight years ago. From there, growing and expanding in to three companies, Real Estate, Property Management and Maintenance, that all support and work with each other. She will go on to tell you that her parents are her inspiration and her heroes and that working with them has been the most wonderful unforeseen blessing.

When it comes to business sometimes all we see is the end product, you don’t get to see what goes on inside. I’m here to tell you that with us, it’s not always just business. Everything we do here is personal. Everything we do here is personal because behind what you see is a family committed to one philosophy. That philosophy includes hard work, client dedication and community.

That right there is why customer service is so important to us. When you decide to work with Walters & Co. you can count on being our number one priority because we will treat you like family too! We hope that today’s newsletter gives you all a peek inside our daily lives. Walters & Co. wouldn’t be what it is today without our amazing friends, family and clients. We can’t thank you enough for your continued support!

Happy Friday and Halloween Weekend everyone!

To celebrate Halloween Weekend, this week we’re featuring some of the most infamous real-life homes that went on to inspire popular Hollywood horror films!

From the Amityville Horror house to the Old Arnold Estate in Rhode Island that inspired the first Conjuring movie, these properties pique public interest, but very often fetch sale prices that are well below the list price. Here are five of these awesome homes!

Credit: Coldwell Banker Harbor Light

The Amityville Horror House

The Amityville Horror house is perhaps the most notorious haunted home in America. The murders that occured at the property and subsequent paranormal activity inspired a best-selling book and a film franchise that spans 38 years and 10 movies.

The home sparked renewed interest in March 2021 when Ronald DeFeo Jr., the convicted serial killer who perpetrated his crimes in the home , died in prison at 69. The property was last listed in June 2016 for $850,000 and sold in March 2017 for $605,000.

Credit: Ashley L. Conti

The Pet Sematary House

The Pet Sematary house is a four-bedroom property that Stephen King and his family rented in the late 1970s. It was there that King came up with the idea for his best-selling novel. Events such as King’s daughter’s cat being hit by a truck in front of the home and local children constructing a pet cemetery in its backyard helped inspire King to write the novel.

Located on River Road in Orrington, Maine, the home was last listed in August 2017 for $255,000, but a sale was never reported.

Credit: Mott & Chace Sotheby’s International Realty/Blueflash Photography

The Old Arnold Estate

Following the release of The Conjuring in 2013, the owners of this centuries-old 14-room farmhouse in Rhode Island threatened to sue Warner Bros. Their property and the investigation conducted there by the late, famous paranormal researchers Ed and Lorraine Warren inspired the film, but it was constantly trespassed upon after the film became a box office hit.

In the wake of the film’s release, the nuisances became too much for the homeowners and they listed the estate for sale, but eventually took it off the market. The property was again listed for sale in September 2021 for $1,200,000.

Credit: Dan Goldfarb

The Sowden House

The Sowden House garnered the nation’s attention in 1947 in the wake of the Black Dahlia murder. Built in 1927 and designed by Frank Lloyd Wright, the home is where Dr. George Hill Hodel lived and allegedly dissected the body of Elizabeth Short.

In the early 2000s, Hodel’s son Steve brought a cadaver dog into the home’s basement and claims it detected the scent of decomposed human remains. However, nothing came of the younger Hodel’s investigation. The home most recently sold in January 2018 for $4.7 million.

Credit: Sotheby’s International Realty

The Dakota

Perhaps most notorious for being the location of John Lennon’s assassination, The Dakota is one of the most prestigious co-ops in Manhattan with many celebrities having called it home over the years.The Dakota also has a storied supernatural history, with the most famous ghost in the building being the Crying Lady who is said to walk the co-op’s halls.

Several movies have been filmed in The Dakota, most famously Rosemary’s Baby in 1968. The film is set in The Bramford, which is actually The Dakota, where many of the movie’s interior and exterior were filmed. Most recently, a four-bedroom apartment sold in the building in March 2020 for $9.75 million.