Coventry Home For Sale

5929 S Wolff Court Littleton, Colorado 80123

NEW PRICE!! $50,000 price drop! Don’t miss this beautiful home in the prestigious Coventry neighborhood for under $1 million! Much sought after Coventry is a wonderful, gated community only a few minutes from downtown Littleton and all that it has to offer. Enjoy the private clubhouse and pool in a park-like setting, the new tennis courts and the private pond that features fishing in the summer and ice skating in the winter. This friendly neighborhood also features many holiday events throughout the year. This lovely 4BR/4Ba ranch home is situated on a cul-de-sac just steps from the aforementioned pool. Gleaming hardwood floors and plantation shutters throughout. Spacious formal rooms. A warm & inviting family room with a gas fireplace and built-ins. The cooks kitchen features granite counters and double ovens, as well as a bright and airy breakfast nook. The roomy primary suite features a wood-burning fireplace and large sliding glass door that opens onto your covered patio. There are 2 more secondary bedrooms on the main floor as well as a full bath. The whole house attic fan will allow you to enjoy the fresh air of those cool Colorado evenings without turning on the central AC. The finished basement features an additional ensuite bedroom and plenty of room for all of your games and workout equipment. Situated on over 1/3 of an acre, there is plenty of room to enjoy the outdoors as well. New stone-coated steel tile roof and new furnace in 2023. Great Littleton schools. Don’t miss this rare find in Coventry! Set your showing today!

Click Here for More Information

Willie Walters. 303-908-2330. [email protected]

Homefront Highlights: April 2024

|

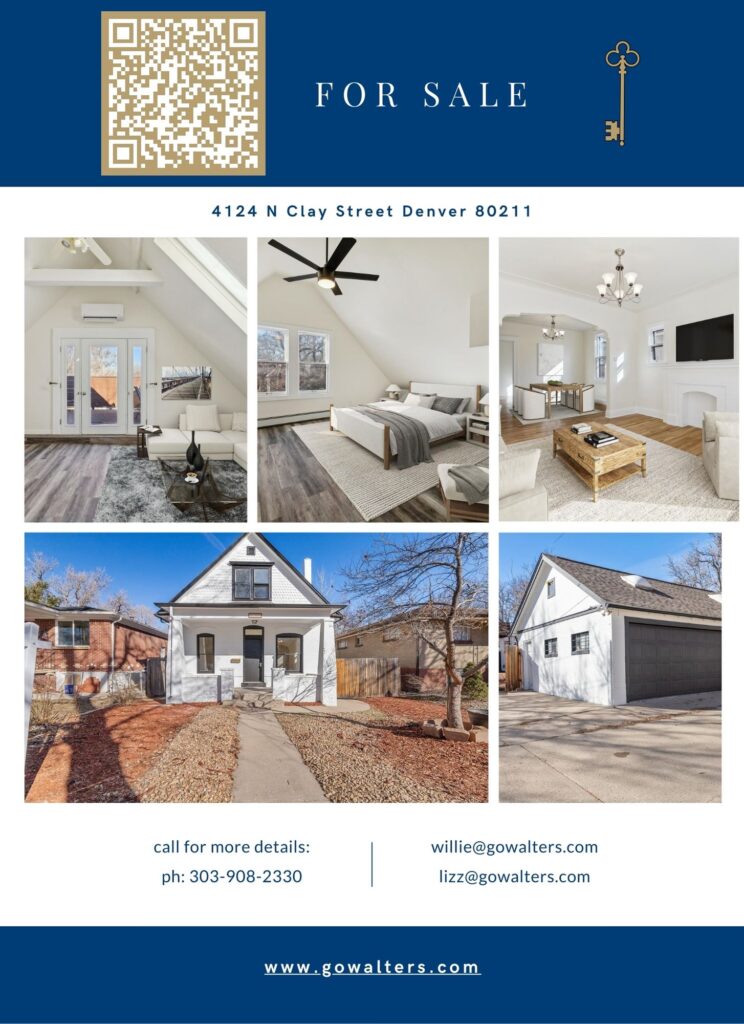

Denver Home For Sale- Investment Property

Scan QRcode above for more information and pictures!

Incredible investment opportunity. Don’t miss this all new Sunnyside gem. 2 Mother-in-law suites that lock-off and would make great AirBnB’s or short-term rentals. Live in 1 unit and rent out the other two! Comprised of a 3BR/1BA unit on the main floor, a 1BR/1BA unit on top floor (with large deck) and a 2BR/1BA unit downstairs. This one has it all. Everything is brand new. Top to bottom. New Boiler. New plumbing & electrical. All brand new appliances. It also boasts an over-sized 2 car garage with workshop that is zoned for an ADU if you wanted to add a 3rd rental! This property could be exactly what you’re looking for. It is in a great location on a tree-lined street that is walkable to many restaurants & bars. Just a little over a mile to all the Tennyson St. nightlife. What more can you ask for. This property would be a terrific chance for the right person that wants to live in Sunnyside and build some wealth at the same time. Schedule your showing today!

Broker: Willie Walters (303) 908-2330

MLS#5810955

Homefront Highlights

March 2024 Housing Update

~ Maya Angelou

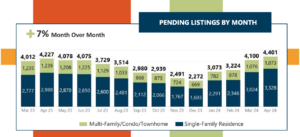

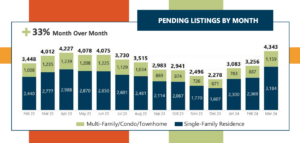

Pending Home Sales are Up:

Homebuyers continued to enter the Denver metro housing market. In March, 4,343 new contracts for home purchase across the Denver metro area. That’s 8% more than last year and 33% more than last month. Homes pending purchase is a leading indicator of future home sales.

Days on Market Down:

In March, homes spent a median of 12 days actively available for sale, according to REcolorado data. Buyers sped up their decision making, executing contracts on homes nearly two weeks faster than last month.

Large Demand for Homes 1MM + :

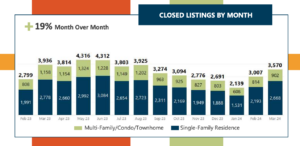

Home closings increased for the third consecutive month. In March, 3570 homes closed. The closing price of those homes was 5% higher than last year and more than 3% higher than last month, thanks in part to strong demand for homes priced above $1 million.

Commentary:

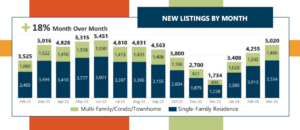

Inventory levels are rising, But remain tighter than we like to see for a balanced market. While buyer activity is surging, there is some positive news for those hoping to purchase a home. The number of new listings added to the market inched up slightly compared to last year and saw a more substantial 18% increase from February. This trend has continued year-to-date, with 11% more new listings coming onto the market compared to the same period in 2023. This increase in new listings has helped boost overall inventory levels. At the end of March, there were 47% more active listings available compared to last year.

The news of a strong economy is fueling buyer demand. The strong demand is likely due to a combination of factors, including pent up demand and continued strength of the Denver Metro economy. Low unemployment and healthy job growth are putting more money in people’s pockets and boosting their confidence to buy a home. Millennials have taken the place of Baby Boomers as the most active Buyers year over year.

Interest rates continue to be a popular topic in a lot of our conversations. Some younger buyers are still asking when will they be able to purchase a home? When will rates come down? The quick answer is we don’t know for sure but maybe by years end.

Nar Lawsuit Update:

Nothing much has changed yet because the lawsuit has not received final approval from the DOJ. That being said, most of the changes that have been proposed will likely be put into place just as they are right now. The Walters Group has already started implementing the new rules into our business so that we can get ahead of the curve regarding new negotiation strategies and educating our clients about the changes.

If you would like to chat about Real Estate or Property Management please Click Here to reach us.

Real estate is more than transactions; it’s about building relationships and helping dreams come true. Your confidence in our services means the world to us, and we are committed to continuing to provide you with the highest level of expertise and service.

Thanks ReColorado for the information/stats

February 2024 Housing Update

~ Will Rogers, actor

February Continues to Boost Inventory

Inventory levels at the end ofFebruary were 25% higher than last year and 176% higher than two years ago thanks in part to sellers bringing listings to the market. Data shows double-digit increases in the number of New Listings for the second consecutive month as sellers brought 4,267 homes to the market.

Buyer Activity Up and Days on Market Down

Home shoppers were active in February. Throughout the month, they executed contracts on 3,454 home listings. The number of listings pending sale in February was less than 1% higher than last February and 11% higher than last month. Those homes stayed actively available in REcolorado MLS for 25 days, 2 days less than last February and 12 days less than last month.

Median Home Prices on the Rise

February brought both year-to-year and month-to-month increases in home closings. Strong demand pushed closing prices up. February’s median closed price was $575,000, 3% higher than last year at this time.

Commentary:

The housing market is changing by the month. Inventory is way up as you can see and yet home prices are up as well. The Denver market is defying basic economics right now. How long can it continue in this manner? That is the question we all wish we could answer. The Spring market is here and we will have to see what opportunities present themselves with such a large increase in inventory. Buyer’s and Sellers waiting on interest rates to come down is already having an impact on the market. Additionally, recent economic statistics are shining a light on the sticky inflation data that the FED does not like. We will have to wait on those lower rates that were predicted to kick off in March until those numbers begin to change. As always we will be watching for opportunities for our clients and sharing them here every month.

Nar Settlement:

We cannot put out an update without talking about the NAR Settlement. There is a lot of information floating around correct and incorrect. (Click Here to Read More) . The effects of this are unknown and will remain that way until the folks that regulate us (DORA) wrap their brains around what will be required. They have about 10 weeks to do so. There are some facts about Willie and I and the way we approach fees and commissions with our clients that we think we need to make crystal clear. Willie and I use Buyer and Seller Agency Contracts (required by the state) and have since we started in the business (2007/2008). Those contracts explain how and what we get paid. They also disclose what is being paid out to Buyer Agents if we are listing a property for sale. We have always been completely transparent, and always will be.

Our MLS (multiple listing service), ReColorado does not require membership to the National Association of Realtors to post our listings for sale (we do pay a higher monthly fee if we are not a member). There are real estate brokerages that do require membership but it is not the MLS. As an independent brokerage Willie and I made the choice to leave NAR 2 years ago, as it was not advantageous to our business or to our clients. We are independent agents that use our own moral compass to conduct our business and follow the laws of Colorado for each and every transaction. As we know more you will know more. I would count on many updates from many sources as even the lending world will be affected by this settlement. If you would like to speak about this further we are always available.

If you would like to chat about Real Estate or Property Management please Click Here to reach us.

Real estate is more than transactions; it’s about building relationships and helping dreams come true. Your confidence in our services means the world to us, and we are committed to continuing to provide you with the highest level of expertise and service.

Thanks ReColorado for the information/stats

Demystifying the NAR Settlement

Understanding Its Possible Impact on Real Estate

In recent days, the real estate world has been abuzz with discussions surrounding the National Association of Realtors (NAR) settlement . With significant implications for real estate agents, home buyers, and sellers alike, it’s essential to unravel the complexities of this settlement and understand its broader ramifications. Today, we’ll delve into the details of the NAR settlement, exploring its origins, key components, and the potential effects on the real estate industry.

Understanding the NAR Settlement:

The NAR settlement stems from 2 lawsuits one class action and one filed by the Department of Justice (DOJ) against the National Association of Realtors, alleging anticompetitive practices that suppress competition in the real estate market. At the core of the lawsuits were NAR’s rules regarding the sharing of property listings among many other things, which the DOJ argued hindered competition and limited consumer choice.

Key Components of the Settlement:

1. Changes to MLS Rules: One of the central aspects of the settlement involves revisions to the rules governing Multiple Listing Services (MLS), the databases used by real estate agents to share property listings. NAR has agreed to make significant changes to these rules, allowing for more transparency and competition in the market.

2. Brokerage Options for Sellers: The settlement also aims to provide sellers with more flexibility in choosing the services they receive from real estate agents. This includes the option to purchase limited services, such as listing a property on an MLS without additional representation.

3. Prohibition of Certain Practices: NAR has agreed to refrain from implementing certain practices that the DOJ deemed anticompetitive. This includes restrictions on the ability of agents to offer rebates and changes to the rules governing lockbox access for non-NAR members.

Increased Competition:

1. With greater transparency and flexibility in MLS rules, the settlement could pave the way for increased competition among real estate agents and brokerages. This could ultimately benefit consumers by providing them with more choices and potentially lower costs.

2. Changes to Brokerage Models: The settlement may also lead to changes in the traditional brokerage model, as sellers increasingly opt for limited services rather than full representation. This could reshape the landscape of the real estate industry, prompting agents and brokerages to adapt to evolving consumer preferences.

3. Consumer Empowerment: By giving sellers more control over the services they receive, the settlement empowers consumers to make informed decisions about their real estate transactions. This shift towards greater transparency and choice aligns with broader trends towards consumer empowerment in various industries.

The Wild West of Real Estate Begins

Consumers that live in the state of Colorado have already been using Buyer and Seller Agency contracts to explain the way commissions are split and paid. The main MLS for the Denver metro area, ReColorado, does not require agents to be members of NAR to post properties for sale. Coloradans will see change for sure, but we think we are already a little ahead of the curve regarding the new rules that will come of this settlement. Make no mistake the NAR settlement represents a significant development in the real estate world and here at home, with far-reaching implications for agents, buyers, and sellers. By addressing anticompetitive practices and promoting greater transparency and choice, the settlement aims to foster a more dynamic and consumer-friendly real estate market. As these changes take effect, stakeholders across the industry will need to adapt to a new landscape characterized by increased competition and consumer empowerment.

January 2024 Housing Update

|

|

|

|

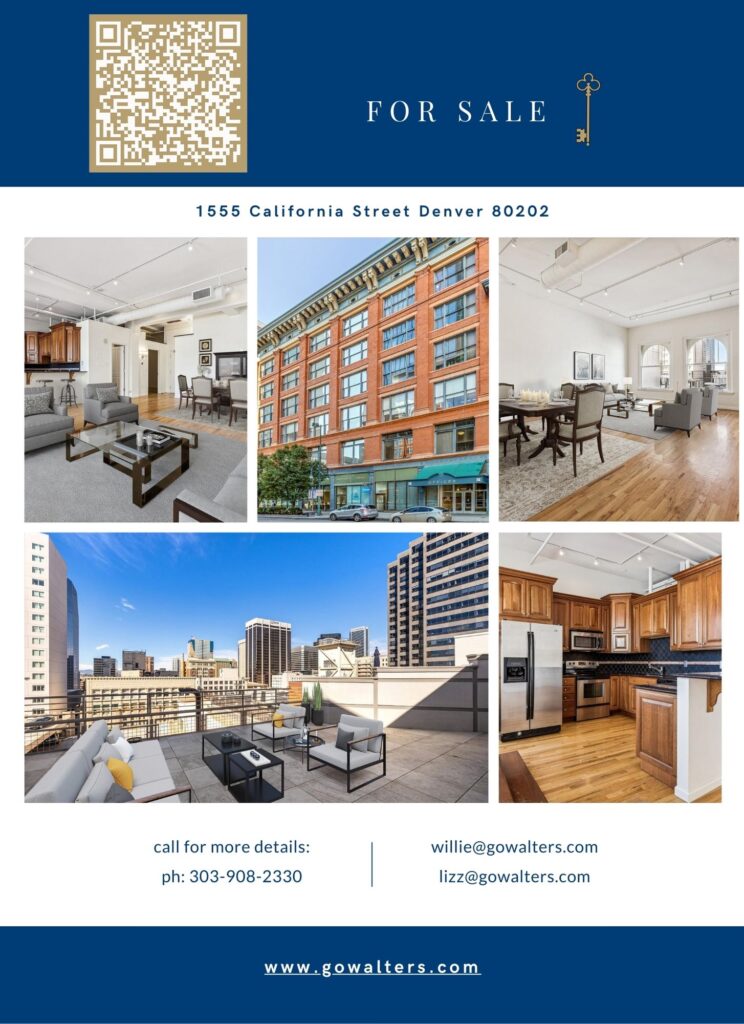

Denver Condo For Sale – Less than $400K

Scan QRcode above for more information and pictures!

This is a must see! Downtown living at its finest with your own 450sf private terrace! Outdoor space downtown, at this price point, is unheard of. Walk to literally everything that downtown Denver has to offer. The Convention Center, the Pavillions, tons of restaurants. Light rail is across the street! This unit is light & bright. 3 huge windows plus a skylight. Beautiful hardwood floors. Nice sized, very workable kitchen with great updates and appliances. And the patio! Did I mention the patio? It is HUGE. Just imagine evenings enjoying a beverage and watching the sunset. How about New Years Eve fireworks or the 4th of July. Your friends will love to come over. The Denver Dry Goods building is steeped in history. Set your showing today and start living your best urban life.Buyer to verify the accuracy of any information provided in the MLS listing including, but not limited to: square footage, bedrooms, bathrooms, lot size, HOA information, parking, taxes or any other data that provided for marketing purposes.

Broker: Willie Walters (303) 908-2330

MLS#4515131

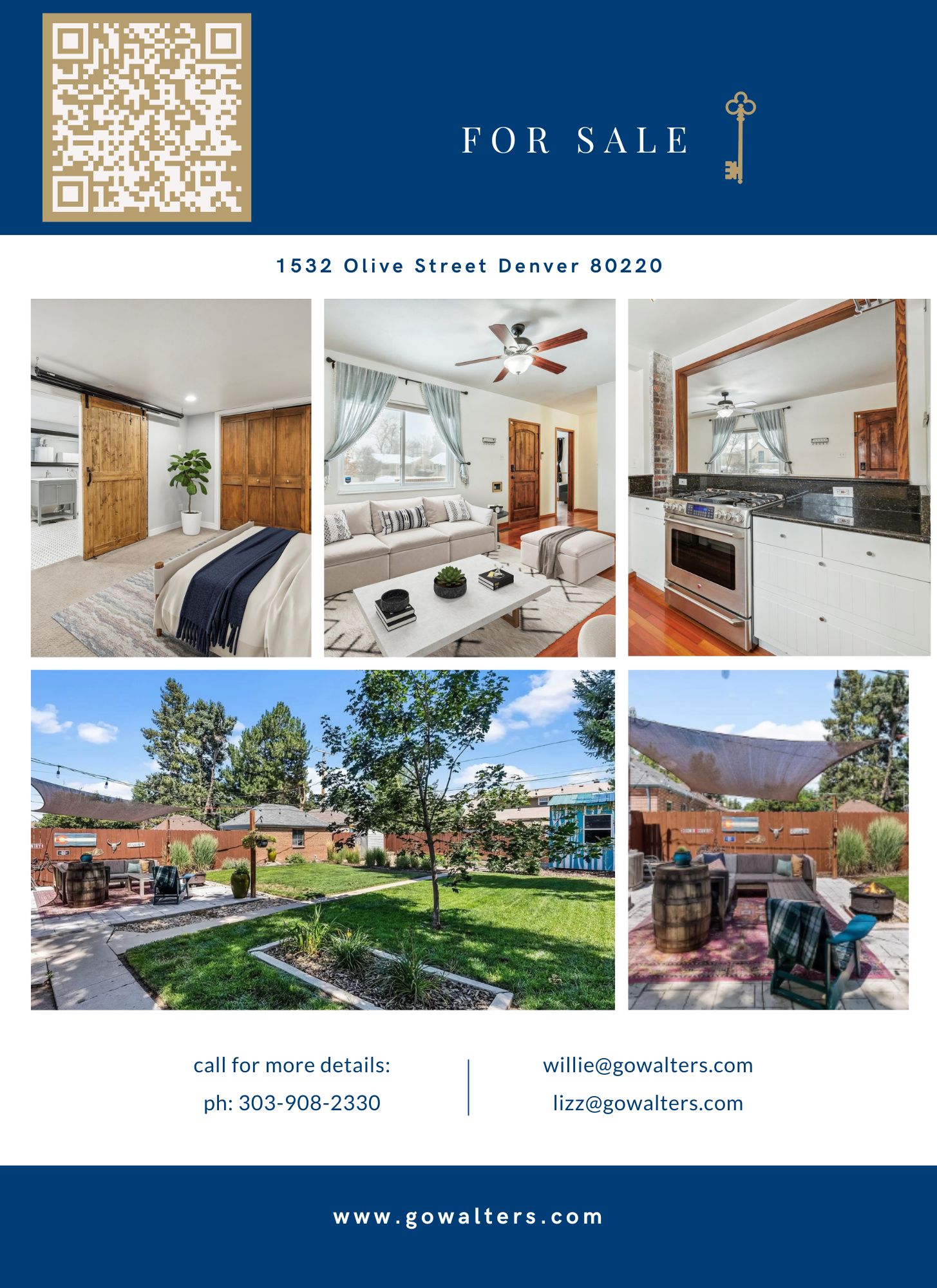

Home For Sale in Parkhill Colorado

Click Here for More Information Today

NEW PRICE on this inviting Bungalow nestled in the heart of Denver* Boasting 3 bedrooms, 2 bathrooms, 1 car attached garage and Large Professionally Landscaped Front and Back Yard* The well-appointed Kitchen features Contemporary finishes with Stainless Steel Appliances and Direct Access to the AMAZING back yard* The Open Living Spaces create an ideal environment for both Daily Living and Entertaining*The Basement has Options: The pictures present it as a Large Primary Suite* The Current Owner used it as the Primary and a Prior Owner used it as a Media Space* You cannot forget all the Natural Light, Cherry Flooring and updated Bathrooms*Step outside to discover the large, Meticulously Manicured Backyard, providing a Private Oasis for outdoor Activities and Gatherings* Combined with the Attached Garage there is extra parking available on the extended driveway* With thoughtful Updates throughout, this Home offers the Perfect combination of Modern Living and Loads of Denver Charm* Great South Park Hill location one block to Fiction Brewery, walkable to Oneida Park shops and restaurants, easy access to Central Park and City Park*Don’t miss the opportunity to call this Denver gem your own* Some notable updates: Basement Projector and Screen, Stamped Concrete Patio, Outdoor Shed newly Painted, Newer driveway – 2021, Newer insulation in the attic – 2021, Newer paint throughout 2020-2021, Tankless Hot Water Heater and Newer Sewer Line and water supply line – 2021*

Broker: Willie Walters (303)-908-2330

MLS # 9162727

MLS # 9162727

2024 Denver Real Estate Market Predictions

Bold Predictions Commentary for 2024

“This is not the way it will always be” -Unknown

This Post is filled with predictions/guesses for what you can expect in Real Estate next year. As click-bait fills your inboxes, social media and televisions we want to give you some real data and ideas collected from smarter people than us for what we think is coming in 2024. Let’s get to it!

Existing Sales/Transactions

It is wildly thought that next year’s transactions will mimic 2023. We saw the number of transactions fall to levels we have not seen since 1998-1999. Transactions dropped over 22% from 2022 to 2023. In the stock market that would be considered a Bear Market, and you would see stock prices move lower, however home prices have remained mostly the same year over year (supply and demand see below). To say that Real Estate has been all over the place in 2023 is not an exaggeration. While some smarties are predicting home sales to remain the same, some are calling for a 12-18% increase if mortgage rates get below 6%.

Mortgage Rates

Lawrence Yun, Chief Economist for NAR, is calling for 4 rate drops next year bringing mortgage rates to 6.5% for a conventional 30 year loan. He believes while our GDP is holding strong for now, that when analysis comes out for Q4-2023 and Q1-2024 we will see a weakened economy. This coupled with a continued reduction in inflation will be the main drivers for the Fed to begin reducing its benchmark rate in 2024. There are others that say by mid year mortgage rates will fall below 6% possibly to 5.75%. If this happens you can expect the housing market to take off again. This theory has been tested time and time again this year by Home Builders. When they buy down the mortgage rate for homebuyers below 6% their inventory disappears. With confidence we think this can be applied to the existing home sales market as well.

Pent Up Buyer Demand

I know we have been talking about Supply and Demand all year, quite frankly for a couple of years now. The graphs we are sharing today will draw a very clear picture of what we are talking about. Millennials, new construction, foreign buyers and those that “love the rate” are the key contributors to our supply and demand issue. The average age a child leaves home in the Millennial Generation is 26 years old. Their household formation average went from 32 years old to 35 years over the last year or so. In 2024 there will be 45 million people 35 years old, the largest amount of people at home buying age ever in our history. What is notable and should not be ignored is the generation coming right behind them. They are every bit as big as the baby boomers in size and will also have an effect on our housing markets for years to come. When we came out of the Covid Era we were 5 million homes short for the amount of buyers that were active in our market. We continue to be short as building homes has become difficult business mainly because of labor (costs and bodies) and supplies continue to be inconsistent. Another weight on our supply issue is the amount of people buying Real Estate from Canada (along with other foreigners) in the US. Canadians buying Real Estate in the US was up 31% in 2022 and another 20% in 2023. Finally, we have commented on repeat month over month about folks with super low mortgage rates sitting on their real estate afraid of moving up or down, in or out. If the predictions are correct and we get below that 6% number you can bet those people will take their appreciation and run into better homes, vacation homes or smaller homes. It is inevitable.

Commentary

We always say that predictions are silly and at our core we believe that. What we have gathered here for you today is something better than blind predictions, it is educated guesses taken from data shared by many industry professionals. These are all national numbers that don’t always apply directly to the Denver Housing Market, but often do because of our quality of lifestyle and age of population (at least over the last 7-10 years). We think that Denver may keep with the National trend in 2024 and 2025- stay tuned. There are more predictions, guesses and information in the full article in our Blog.

Thank you again for supporting our business and our family. As we are rounding year 10 in business with our partner companies we are beyond grateful for awesome clients and awesome employees. Willie and I are excited to see what 2024 brings in for us and for you!

~We wish you and your families, Peace and Health for the Holidays and all the year through~

We wanted to thank Buffini and Company, and The National Association of Realtors for sharing their data and information with us.

September 2023 Housing Update

In the 11-county Denver Metro area, September brought about a typical seasonal slowdown in the residential real estate market, impacting both buyers and sellers. Here’s a breakdown of the key indicators:

- Closings Down 17%: The number of home closings in the Denver Metro area saw a decrease, down 17% from the previous month. This dip in closings is a usual characteristic of the summer market transitioning to fall.

- 25% Fewer Closings Compared to 2022: When compared to September 2022, there were even more pronounced changes. This year, there were 25% fewer closings, indicating a shift in the market dynamics over the past year as interest rates remain at higher levels.

- Stable Home Prices: Home prices; however, remained relatively stable, with the median closed price of a Denver Metro home increasing by less than 1% when compared to the previous month. On a year-over-year basis, September’s median closed prices were up just 1% compared to the same month last year, as demand leveled off.

- Fewer Newly Listed Homes: The number of newly listed homes in September decreased by 5% when compared to August. Additionally, compared to the same period last year, sellers brought 12% fewer homes to the market. This reduction in listings may impact choices for buyers and the overall competitiveness in the market.

- Buyer Activity Declines: Buyer activity slowed in September, with fewer contracts executed on homes as compared to August. The number of listings pending sale was down 8.5% compared to the previous month. The median number of days it took for a home to move to pending status increased by 5 days, suggesting that potential homebuyers are taking more time to make decisions.

Commentary

Mortgage rates are climbing still, when reading all the talking head commentary I feel like I am in the middle of an opinion tsunami. The predictors have been 100% wrong in terms of mortgage rates this year. They continue to spout all kinds of predictions and at this point the thing to do is ignore it all. Pay attention to time in the market as opposed to timing the market. Ask people who you know and trust what their experiences have been. We can say with a fair amount of confidence, that over time, people have generated more wealth using real estate or the stock market than if they had not. As always, we thank you all for your continued support of our businesses. Willie and I are very grateful for each and every one of you.

If you think The Walters Group can be helpful please don’t hesitate to Contact Us!

July 2023 Housing Market Update

Elevated Interest Rates begin to impact Appreciation

-Housing market activity in the 11-county Denver Metro area remained constrained in July. Closings of existing homes were down 14% compared to last year. July typically brings a decrease in closings due to summer vacations and the July 4th holiday. Compared to June, there was a 12% decrease in closings.

Commentary

When we examined stats for the last couple months and compared them with 2019. We are well below 2019 activity in every way except for interest rates. Interest rates were in the 5% range and the housing market was starting to look like it was headed to a more balanced place. We go back to 2019 because that was the last time the market was not influenced by the pandemic and non-sustainable interest rates. What does this mean for us now? We don’t really know. Everything we know about our housing market feels upside down. Lower inventory usually means higher prices (prices are starting to dip again) and reduced inflation usually means lower interest rates (rates are the same or higher). We are facilitating more cash transactions than ever, and we are seeing more and more buyers being priced out of the market because of interest rates. The road ahead is too hard to predict but we are working hard to keep our clients up to date with all that we know.

In Other News

The Colorado General Assembly recently passed a new radon bill, effective now, requiring more transparency about radon during real estate transactions. The law requires further disclosure from Agents and Sellers about the gas similar to the lead based paint disclosure we use. Our contracts now give Agents and Sellers a formal way to address radon. If you would like to know about the bill that has been passed please click here to read more.

Solar Panel Removal

Some folks are experiencing difficulty getting their Solar Panels removed and put back on while getting their roofs replaced. If this is happening to you please give us a call we have some ideas that might get that new roof on sooner than later!

Coming Soon Listings

We have several listings coming on in the coming weeks, Highlands Ranch, Castle Rock, Aurora. We will be sending a coming soon blast early next week. If you know some looking for some opportunities please send them our way!

9510 E Florida Ave. Denver, Colorado 80247

Location and Price make this Denver 2 Bedroom 2 Bath Condo a Great Deal!

Awesome Room-Mate and/or House Hack 2 Bedroom and 2 Bath Condo; Enjoy the open and spacious Living room/Dining room with Fireplace and Mantel* Primary Bedroom has it’s own Bathroom and Large Walk-In Closet* There is a covered Balcony and Storage Closet too*Kitchen has a full size Pantry and ample Granite Counters* There is a good amount of Closets throughout the unit* Full size Washer and Dryer come with this home*Furnace, AC & Water Heater all less than 1 year old*2 Use Only parking spaces are right outside*Don’t forget the lovely Outdoor Pool that is ready for Summer*Easy Access to DTC, Denver and Cherry Creek making a commute, if you have one, easy* Within 5 minutes from grocery shopping, major highways and public transportation* For the outdoor enthusiasts, the Highline Canal and Cherry Creek State Park are just minutes away, offering endless opportunities for hiking, biking, sailing, dog parks and other outdoor activities. This Condo offers the perfect blend of style, convenience, and location; This is one you won’t want to miss*

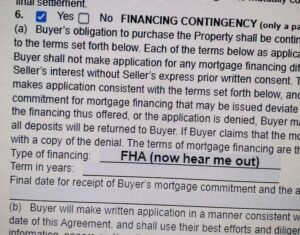

Conventional or FHA Financing, which one is right for YOU?

In 2023 there may be added benefits to inquiring about both options if you are in the market to buy a home. Often times in our more recent markets FHA financing has been frowned upon by listing agents, but that does not mean you shouldn’t explore your options. Below are some benefits of each type of financing:

Benefits of FHA Loans:

- Lower down payment: FHA loans typically require a lower down payment compared to conventional loans. The minimum down payment requirement can be as low as 3.5% of the purchase price.

- Easier qualification: FHA loans have more flexible credit requirements compared to conventional loans, making them more accessible to borrowers with lower credit scores.

- Government-backed guarantee: FHA loans are insured by the Federal Housing Administration, which provides lenders with a level of protection in case of borrower default. This guarantee allows lenders to offer more favorable terms to borrowers.

- Higher allowable debt-to-income ratio: FHA loans may allow for a higher debt-to-income ratio, which means borrowers with higher levels of debt may still qualify for a loan.

Benefits of Conventional Loans:

- No mortgage insurance premium (MIP): While FHA loans require borrowers to pay mortgage insurance premiums, conventional loans do not have this requirement if the borrower puts down at least 20% of the purchase price as a down payment.

- More flexible loan terms: Conventional loans offer a wider range of loan terms, allowing borrowers to choose the repayment period that best suits their needs.

- No upfront mortgage insurance premium: FHA loans typically require borrowers to pay an upfront mortgage insurance premium, while conventional loans do not have this requirement.

- Potentially lower overall costs: Depending on the borrower’s creditworthiness and financial situation, a conventional loan may offer lower interest rates and lower overall costs compared to an FHA loan. This is especially true for borrowers with excellent credit scores.

It’s important to note that the specific benefits of FHA loans versus conventional loans can vary depending on individual circumstances, such as credit score, down payment amount, and financial goals. Consulting with a mortgage professional can help you understand which loan option is best suited for your specific situation in 2023.

We are happy to share our Lender List with you anytime! Click Here to Chat Today!

2023 Property Tax Appeals – Tips and Tricks

Be Clear, Be Concise and Be Kind

This seems to be the subject of the Month. We have had so many folks reach out to us about appealing their property taxes and in the meantime we have gone on a mission to learn all we could about what a successful appeal looks like.

There are 3 components to your property tax bill:

1) Assessment Rate from State Statute

2) Tax Rate (Mill Levy) based on Taxing Authorities in your Taxing District

3) Assessor’s Actual Property Value based on

Sales in the Study Period: July 1, 2020 – June 30, 2022

The only one you can appeal is the Assessor’s Actual Property Value. The Assessor’s office uses a Mass Appraisal Model which cannot differentiate details. We need to remember that in most cases it comes close but there are valuations that are not correct.

What can you do?

-visit your county website and get the process and any forms you need

-find comparables- solds to your home – remember APPLES to APPLES not APPLES to ORANGES

-when using the study period try to get homes sold as close to June 2022 as possible

-when writing your appeal remember to be concise, be clear and be kind (the sugary type)

-need help? Call Willie or Lizz

Tips:

-If you have an appraisal during the study period (as close to June 2022) that shows a lower value submit that with your appeal

-3 to 5 comparable sales

-Highlight what you don’t like about your house – remember big things: Bathroom count, finished square footage, etc

-If the county shared the comparables they used make sure to verify them

-townhomes and condos rarely are successful on appeal

Finally, the assessor will take your file and now do an individual appraisal on your home using the data and information you submitted and their own. Appeals can cause an inflated value as well so make sure you really feel like yours is overstated. Values that miss by 10K or less are most likely not worth the appeal. The window is closing most counties you have until June 8th some counties you have longer. This process is easy, don’t be intimidated.

Again, if you or anyone you know need some help, advice etc. we are here to help!