Building Your Real Estate Portfolio:

5 Mistakes People Make When Buying a Rental Property

1) Investing Based on Linear Appreciation

People often mistakenly invest in a rental property based on the idea that it will have a linear appreciation or gain in value in the coming years. In our current market we are starting to see more and more investors use this strategy. This is not a good idea. Property values can fluctuate from year to year and often do. An investor may need to unexpectedly sell their property and doing so in bad market can lead to a loss. Instead, investors should always invest based on the cash flow of the property (Willie’s Clients hear this all the time). This is why it’s important to have solid numbers at your fingertips during the vetting process and when buying a rental property. If you are interested in seeing these numbers for a property you own or are interested in buying, Contact Us!

2) Renovations and Rentals don’t usually mix

If you are going to purchase a property strictly for the purpose of renting it out, condition is important. The amount of money you will need to get it “rent-able” needs to be in your spreadsheet. Improvements to a rental property are very different than the ones you do to YOUR home. Beginner investors often under calculate what improvements cost, and that directly effects cash flow and sets the investment up to underperform. Set your eyes on properties that only need small cosmetic changes, if any, and remember that you will have to spend some money on your investment properties to keep them current so that you can compete for the best tenants.

3) Location, Location, Location still matters

Location should be the number one factor when starting your investment property search. This is even more important than the number of bedrooms, selling price, need for renovations, outdoor space, and parking. Don’t get us wrong, those are all important things too! However, you can potentially add square footage, update an older kitchen, or get a yard nicely landscaped. The location of your property is the one thing that you have no ability to change after you sign your purchase agreement. Here are 9 things to consider:

1. Distance from where you live

2. Schools

3. Public Transportation

4. Insurance

5. Walkability

6. Infrastructure

7. Type of Neighborhood – (HOA or no HOA, City or Suburbs etc)

8. Job Growth/Unemployment

9. Population Growth Potential

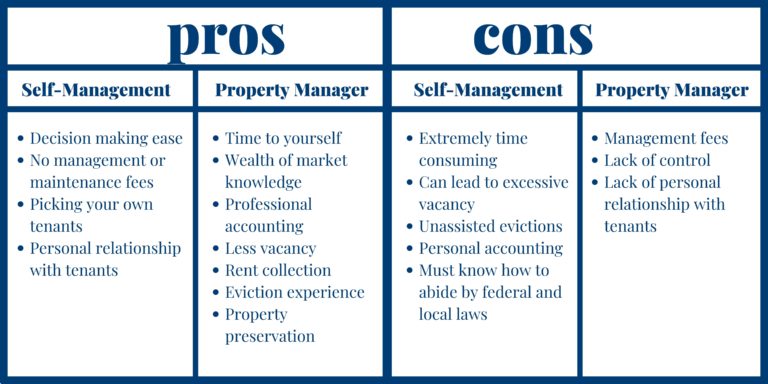

4) Deciding to Self-Manage or Hire it out

This topic always seems to be overlooked when buying a rental property. Knowing you’re your investment is going to be handled day in and day out is of incredible importance. Hiring a property manager can be a great option. After all, who wouldn’t like to know that their investment is being cared for around the clock? However, just like managing a property yourself, there are pros and cons of hiring someone to manage your rental property for you. We’ll run through some of the most common pros and cons of both strategies below. The decision should be made prior to you even beginning to look for property and should be accounted for in your numbers (spreadsheet).

5) Buying Too Many Properties

If you are a novice investor, it is important to avoid buying too many properties at one time. We have clients all the time that want to rush into the market and buy, buy, buy. One should consider buying one property initially to get a feel for the business. Buying a home is different than buying a rental property. Even if you have purchased your first home, the experience of doing so will be vastly different than buying property for investment purposes. In most cases, it is best to buy a single property initially. Doing so will give you a better idea of what is involved in the process. If possible, wait at least 6 months before buying any additional properties. This gives you time to understand all aspects of owning a rental property of your own. Allowing more time for this process allows you to work through any potential problems that may come up. Look at your first rental property as an opportunity to experience the business of property ownership and get a better understanding of it.

In conclusion, owning a rental property can be an excellent way of accomplishing many of your fiscal goals. Rental properties can provide a highly stable income that has tax advantages for the owner. Proper research and guidance is essential during the process. Investigate carefully and avoid these common mistakes. In turn, you may expect to have an investment that can help provide the basis for a comfortable financial future.