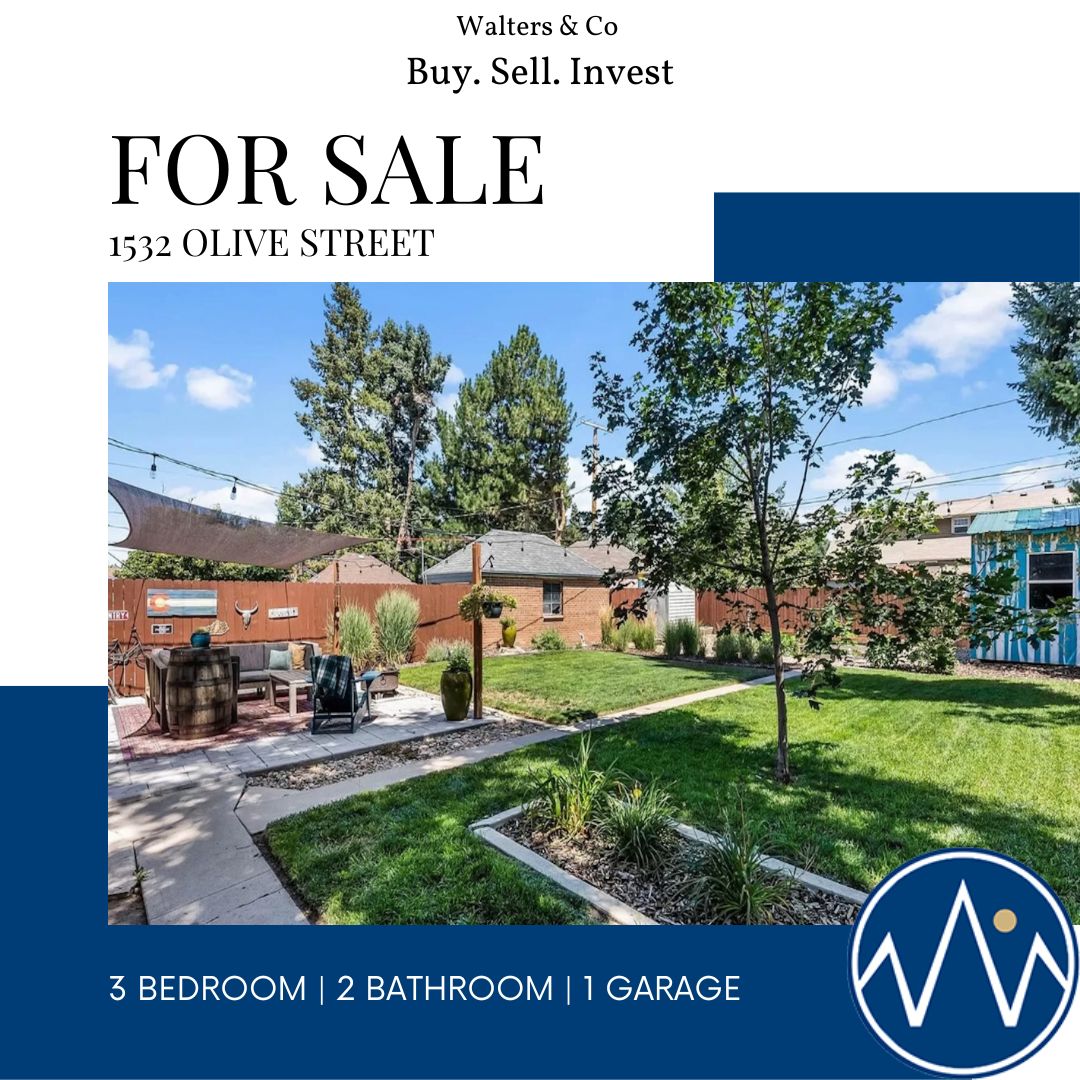

Home For Sale in Parkhill Colorado

21 February 3:41 pmClick Here for More Information Today NEW PRICE on this inviting Bungalow nestled in the heart of Denver* Boasting 3 bedrooms, 2 bathrooms, 1 car attached garage and Large Professionally Landscaped Front and Back Yard* The well-appointed Kitchen features Contemporary finishes with Stainless Steel Appliances and Direct Access to the AMAZING back yard* The Open Living Spaces create an ideal environment for both Daily Living and Entertaining*The Basement has Options: The pictures present it as a Large Primary Suite* The Current Owner used it as the Primary and a Prior Owner used it as a Media Space* You…

Read More