Record Setting December

The Good News:

We saw median prices appreciate 19.78 %. If you waited a year to buy the same house, the price would have gone from $455K a year ago to $545K today. In the real estate market, time is money- a lot of money. Based on the sustained demand for housing and lack of supply we think folks will see double-digit appreciation again in 2022. Since 1991, the Denver Metro area has appreciated around 7.5% a year. That is a solid number considering it has the housing crisis factored in as well.

Records Set for December and 2021!

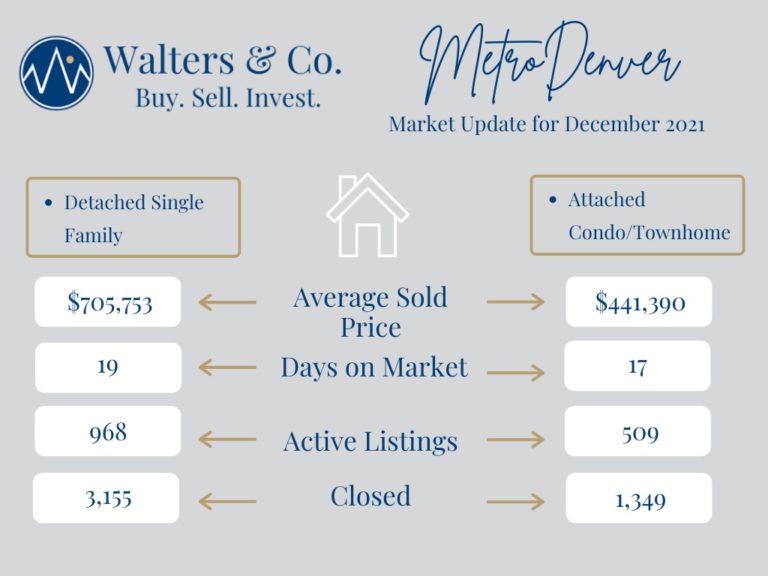

We ended the year with another historic low supply number for Residential properties. December was left with 1,477 detached and attached homes available For Sale. Since 1991, the Denver Metro area has appreciated around 7.5% a year. The average active number of listings for December is 12,652 (1985-2020). The highest number of listings left available at the end of December was 24,603 in 2007.

The Next Big Question for Real Estate In 2022?

Interest rates! Interest rates will be our variable in 2022! With fears of inflation and few purchases of mortgage-backed securities and treasuries by the Federal Reserve rates jumped by 0.25% between December 21, 2021 and January 3, 2022. They are expected to land in the high 3% to low 4% range by mid year. It is not clear what effect volatile interest rates will have on the Real Estate market. What we do know, is that it will have an effect on Buyers’ mindsets and we will just have to wait see how much more uncertainty they will tolerate.

Our Crystal Ball:

The crystal ball says it is fair to assume that what was previously an outlier, the 2020 real estate market, is quickly becoming the norm. What can we do about the historic low supply and continued demand? Build more homes and more cities to change their policies surrounding building. That won’t be a fast fix and the other option is “The Buyers’ mindset”. If you are a buyer in this market, setting your mindset is incredibly important. You should be buying a home because you want all of benefits that homeownership have to offer- stability, equity building, aging in place and a sense of self. You may have to shop for homes that are below your budget knowing you will have to compete on almost every listing. The market is now a sport, you must be laced up and ready to roll at all times. The process can be stressful and complicated, working with a professional to help you navigate the current market is imperative. Intuition and insight cannot be quantified like commission fees but can make that subtle difference between homeownership and not.