Denver Market Update

Welcome to more of the same for home Buyers and Sellers. Sellers experienced 6.75% appreciation from January to February, an increase in value that usually would be considered incredible for an entire year! Buyers continue to put all their cards on the table to win their dream home! Investors ROI is getting squeezed for those that use leverage, as interest rates and home prices climb.

Are Open Houses making a comeback? Last month there were several open houses that reported 50+ people in addition to the 50+ showings for a couple of properties. These kinds of statistics suggest we may be back to visiting Open Houses on the weekends!

I think we can all agree that the 38 inches of snow that have fallen since January 1st is also putting a little bit of a damper on Listings. We have not had this much cumulative snowfall since 1965.

Our advice to Buyers is when you finally see yourself in a home, put down the whole deck of cards to snag it. Don’t hold back, make sure your offers are written well, offer quick closes and appraisal gap coverage, put the most money down that you can and make sure your Lender is on board as well. It’s Spring Break and a lot of folks are back to traveling while we don’t expect an onslaught of inventory this may make the Buyer pool smaller. Buyer’s put your bikinis away and focus on your home buying for the next 3 weeks, you may have less to compete with!

Our advice to Sellers, there seems to be a change in the air. We don’t mean a considerable downturn in the market, but there was a slowing in consumption of homes when we look at the numbers compared to last year. It’s small, but it’s there and it has not happened in long time. This does not mean we will see a Buyer’s market anytime soon, but it points to a possible slowing of Buyer demand. We will be watching this one! Putting your home on the Market sooner than later is probably your best strategy if you are on the fence about selling.

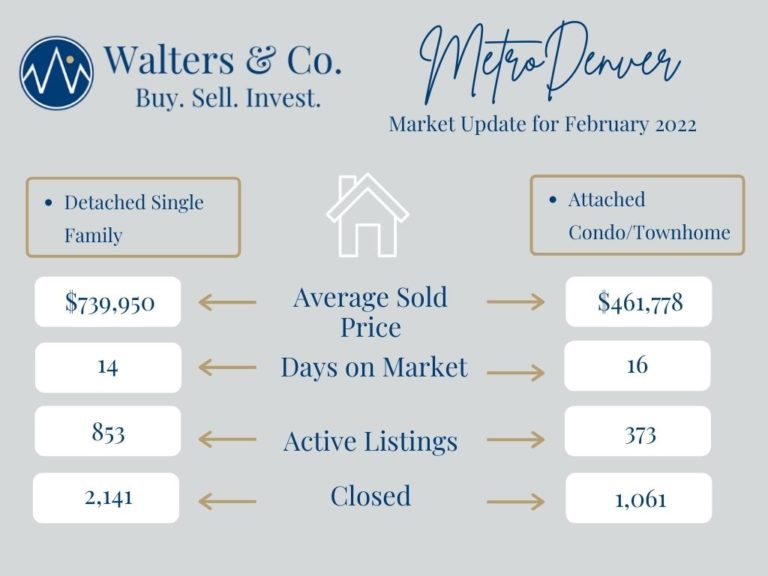

Quick Stats:

*Average Active Listings for February: 13,220

*Record High Active Listings for February: 25,484 (2/2006)

*Record Low Active Listings for February: 1,226 (2/2022)

*We did end the month with more homes on the market than in January

*Mortgage Applications dropped to their lowest level since 2019

*Builders have begun to send their inventory to the open market instead of keeping buyer lists

Our Crystal Ball sees a couple of things this month:

*War put’s pressure on rates to go lower even though they have been tracking higher

*Inflation causes home prices to rise. We may see 10-15% in collective home appreciation in Q1 2022

*There may be a slowing of the market come summertime (come back here in July and see if we are correct) We have said this many times (I know) but when we look at the market after May of 2021 there was slowing, but then it picked up speed as we headed into the fall and winter.

*The uncertainty of the Stock Market drives typically more money into Real Estate

If you know anyone that needs help with buying, selling or investing we hope you will keep us in mind!

Thanks DMAR for the information/stats