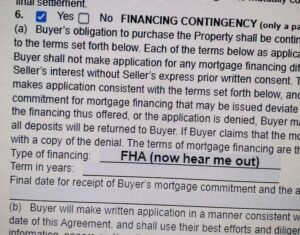

Conventional or FHA Financing, which one is right for YOU?

In 2023 there may be added benefits to inquiring about both options if you are in the market to buy a home. Often times in our more recent markets FHA financing has been frowned upon by listing agents, but that does not mean you shouldn’t explore your options. Below are some benefits of each type of financing:

Benefits of FHA Loans:

- Lower down payment: FHA loans typically require a lower down payment compared to conventional loans. The minimum down payment requirement can be as low as 3.5% of the purchase price.

- Easier qualification: FHA loans have more flexible credit requirements compared to conventional loans, making them more accessible to borrowers with lower credit scores.

- Government-backed guarantee: FHA loans are insured by the Federal Housing Administration, which provides lenders with a level of protection in case of borrower default. This guarantee allows lenders to offer more favorable terms to borrowers.

- Higher allowable debt-to-income ratio: FHA loans may allow for a higher debt-to-income ratio, which means borrowers with higher levels of debt may still qualify for a loan.

Benefits of Conventional Loans:

- No mortgage insurance premium (MIP): While FHA loans require borrowers to pay mortgage insurance premiums, conventional loans do not have this requirement if the borrower puts down at least 20% of the purchase price as a down payment.

- More flexible loan terms: Conventional loans offer a wider range of loan terms, allowing borrowers to choose the repayment period that best suits their needs.

- No upfront mortgage insurance premium: FHA loans typically require borrowers to pay an upfront mortgage insurance premium, while conventional loans do not have this requirement.

- Potentially lower overall costs: Depending on the borrower’s creditworthiness and financial situation, a conventional loan may offer lower interest rates and lower overall costs compared to an FHA loan. This is especially true for borrowers with excellent credit scores.

It’s important to note that the specific benefits of FHA loans versus conventional loans can vary depending on individual circumstances, such as credit score, down payment amount, and financial goals. Consulting with a mortgage professional can help you understand which loan option is best suited for your specific situation in 2023.

We are happy to share our Lender List with you anytime! Click Here to Chat Today!