Don’t Kill the Miller Moths

A Case for Coexistence

Colorado’s beautiful landscapes are home to a variety of flora and fauna, including the humble Miller Moth. While their annual arrival may be met with mixed feelings by residents, the humankind, it is important to recognize the ecological value of these insects and understand why they should not be indiscriminately killed. In this article, we will explore the significance of Miller Moths in Colorado’s ecosystem and highlight the benefits of coexisting with these fascinating creatures.

Natural Pollinators

One of the crucial roles Miller Moths play in Colorado’s ecosystem is their contribution as natural pollinators. These moths, known scientifically as Euxoa Auxiliaris, are important agents in the pollination of various flowering plants. As they flit from flower to flower, they inadvertently transfer pollen, enabling plant reproduction and the production of fruits and seeds. By allowing Miller Moths to carry out their pollination activities, we can help maintain the delicate balance of Colorado’s plant life.

Nutritional Value for Wildlife

Miller Moths are valuable food source for many native animals in Colorado. They serve as an important link in the food chain, being consumed by birds, bats, and other insect-eating wildlife. By eliminating Miller Moths, we disrupt this crucial food supply, potentially impacting the survival and reproduction of species dependent on them.

Cultural and Educational Value

Miller Moths have become a cultural phenomenon in Colorado, with their annual migration drawing attention and fascination from residents. They serve as an opportunity to educate the public especially children, about the natural world and the importance of biodiversity. By observing and learning about Miller Moths, we can foster a sense of appreciation of the interconnectedness of ecosystems and inspire stewardship for the environment.

Let us celebrate the beauty and value of the Miller Moths by coexisting with them, respecting their role in the web of life, and embracing the lessons they offer about our interconnectedness with nature. And in case you are still wondering….No they don’t eat human clothing or food if they get inside your home.

The Many Faces of The Denver Housing Market

As we head closer to the much-anticipated Spring Real Estate Market we are seeing a split view. Our client’s stories vary, on one hand they are seeing homes under 400K selling for less than asking price with lots of contract contingencies. The other hand in the luxury market (above 1 million) experiencing multiple CASH offers with no contract contingencies accepted (The stats say otherwise by the way: Homes under 1 million getting 100% of asking price and homes selling over 1 million getting 99.23% of asking price). In most cases these stats do not support what our active clients are seeing. We know you are getting mixed messages. Our best advice is that you can’t look at the market with a wide lens; you have to drill down to the specifics of each transaction to get a clear picture.

April Stats were Interesting

Active inventory was up, closed homes sales were down, average close price and average median close price were up month over month. Year over year we are down somewhere between 3%-6% in appreciation, a softening that is totally expected with the historical interest rate hikes we have seen this year. In addition, days on market are down big time again. April saw the lowest number of closed homes since 2011. It is also the first time since 2008 that closed home sales dropped from March to April.

April 2023 Housing Market Update

Active Inventory: 4,620 up 2.3%

Closed Sales: 3,701 down 7.91%

Average Close Price: $682,061 up 2.56%

Days On Market: 29 down 21.62% (This is another big drop)

(Stats Reflected here are MoM March to April)

Property Values Across the Denver Metro Area are Way Up

According to a recent Denver Post article written by Aldo Svaldi, homeowners across the state will need to set aside more money to cover their property taxes next year — significantly more money — based on the higher property values that county assessors have calculated and will notify them about early next month. Nine county assessors along the Front Range on Wednesday revealed the median increases in residential properties, which are valued on a two-year cycle in Colorado. The two-year increases are “historic” and “unprecedented” assessors said, ranging from 33% in Denver County to 47% in Douglas County. If you would like to read more of this article click here. To protest your home valuation call or visit your county’s website for directions on how to file your complaint. There are also companies that offer this service for a fee.

The Fed Funds Rate goes Higher

The Federal Reserve raised its fund rate by .25% today. Chairman Powell’s speech included different language than we have heard since they began their historic hikes. He said, “what we need to focus on are the words maybe and some as opposed to ongoing”. He also repeated that we can count on the Fed doing what they need to do to get inflation down to 2 percent.

What can you Expect for the rest of 2023?

Expect the multifaceted market to continue throughout 2023. Our appreciation outlook is positive because of continuing inventory pressures. We predict you will see a small gain in year over year appreciation by the end of 2023. Mortgage rates will be higher in the short term and may begin to come down by the second half of the year. Thank you all again for supporting our businesses we are grateful.

Data represents Attached and Detached Homes in the 7-county metro area.

We would like to thank DMAR, Yahoo and The Denver Post for information and statistics used in crafting this article.

JUST LISTED!

4973 S DILLON ST. #130 AURORA COLORADO

ASKING PRICE: $314,900

BRIGHT AND OPEN FLOOR PLAN

Property Highlights

- 2 BR/2 BA (2 Primary Suites with Walk In Closets!)

- Cozy Gas Fireplace in the living room

- Large Living and Dining Rooms

- Detached Garage and a Permitted Open Parking Space

- Washer and Dryer Stay

- Vaulted Ceilings

- Tons of Natural Light

- Front Porch to enjoy Sunset Skies

For More Information Contact Us Today!

Real Estate March Madness

A Busy March

If you thought the basketball version of March Madness was Mad hold on to your nets because it clearly bounced into the Real Estate Industry as well. Between Mortgage Rates, CPI, the Fed, lack of inventory and of course bank failures we were all over the place nationally and regionally last month. Active inventory is up, closed homes sales are up, average close price is up and days on market are down (see stats below for exact numbers). All of that speaks to a very active Metro Denver Real Estate market for the month of March. Last month’s pending homes sales climbed 22% and closed homes sales jumped 32% from February. We can’t fail to mention that part of March’s housing activity is also because of seasonality.

March 2023 Housing Market Update

Active Inventory: 4,516 up 19.53%

Closed Sales: 3,790 up 32.29%

Average Close Price: $665,390 up 1.44%

Days On Market: 37 up 22.92% (This is a big drop)

(Stats Reflected here are MoM February to March)

The Price is Right!

Homes which sold without a price reduction are out selling homes sold with a price reduction by 2 ¾ percent. When out showing, making offers and listing homes in this market condition and location are key. What we are seeing is homes that are in ready to sell condition, cleaned, well taken care of, yard work done and staged are selling for over ask with multiple offers no matter what the price point. Add to that a slightly below list price and you can count on a high scoring weekend regarding showing numbers and offers received.

Credit Tightening Coming Your Way?

This idea that credit tightening could bring on the recession and crush the housing market has been floating around for months. According to many sources credit tightening is mainly affecting Car, Commercial and Personal Loans. Several lenders confirm that home loans are less restrictive now than they have been. The loosening of restrictions is part of this administration’s commitment to those people who have missed the opportunity to buy a home because of pricing and lending over the past couple of years.

Goldman Sachs and the 99%

On March 2nd of this year Goldman Sachs was quoted in a Fortune article on Yahoo that 99% of all home loans nationally are under 6% or current market rates. They also stated that 28% of those are under 3%. The article says, “Think about it like this, if you took on a $600,000 mortgage and your rate is 7%, your monthly principal and interest payment would be $3,992. But with the same size loan and a rate of 3%, your monthly payment is slightly over $2,530 a month.” This mathematical equation equates to people not moving and this may influence our housing market for years to come.

Mr. Kinman

There is another story in this article about a gentleman that purchased his home in California at a 3.68% mortgage rate in 2016 and refinanced in 2021 to 2.42%. He’s splitting his time between California and Portland, Oregon, after getting a new job. Instead of losing his low rate that he’s locked into and selling his home, he’s renting an apartment in Portland and traveling between the two states for work—which he says is cheaper because of how reasonable his mortgage payments are.“I can’t afford to sell because I don’t want to lose that rate,” he told Fortune. “If I ever want to move back to California, it’s going to be impossible because I’ll never get a rate lower [than that]. So I am scared as hell to let go of the house at that rate, and I also can’t afford to buy in Portland because the pricing and the rates are too high.” If rates weren’t so high, he said, he’d sell the home and purchase in Portland.

Yet another reason and win for Investing in Real Estate. Across the board and over time real estate scores points.

Looking into the Spring Market

It appears that the spring market is beginning to show its colors not only in our gardens but in our housing market too. Mortgage rates are settling in, folks have grown used to them and inventory remains lighter than demand. Without change to inventory home prices will remain flat or will slightly rise over the next couple of months. What happens if the Fed stops raising rates and inflation starts to slow at a faster rate at the same time? More Madness for our housing market for sure. Thank you all again for supporting our businesses we are grateful.

Data represents Attached and Detached Homes in the 7-county metro area.

We would like to thank DMAR and Yahoo for information and statistics used in crafting this article.

Manifest an Early Spring by Sprucing up for It

Spring Cleaning Tips

Time for spring cleaning has arrived! Here is a helpful list of items that you may clean on a regular basis, but if you don’t, Spring is the perfect time to get after it! We have lots of cleaning referrals if you need one so please don’t hesitate to reach out!

Every Room in the House:

-Dust ceiling fans and light fixtures

-Clean windowsills and window tracts and vacuum window treatments and window blinds

-Wipe down shoe molding and dust room corners for cobwebs

-Test batteries in all your smoke and carbon monoxide detectors, disinfect doorknobs, cabinet handles and light switches

Bathrooms:

-Organize cabinets and drawers

-Properly dispose of old medicine and toiletries

-Scrub the shower and bathtub

-Wash shower curtain and floor mat

-Scrub the toilet and tile around it

Living Room:

-Remove furniture cushions and shake them out and vacuum the crevasses

Kitchen:

-Wipe down microwave, coffee maker and other small appliances

-Empty the crumb tray in your toaster and or toaster oven

-Empty refrigerator and defrost freezer

-Clean you over and scrub the stovetop or range

-Clean out cabinets and wash drawers

-Sanitize the sink and clean the inner rim of your sink guard

-Clean refrigerator shelves

-Clean behind and beneath refrigerator

Bedrooms:

-Organize drawers and closets

-Wash bedding and pillows

-Rotate mattress

-Disinfect kids toys

Laundry:

-Clean behind washer and dryer

-Thoroughly clean lint trap in dryer and washer

Home Office:

-Clean keyboard with canned air

-Disinfect computer mouse and phone

Outdoors:

-Remove everything from your garage and reorganize

-Pressure wash your deck and outdoor furniture

-Hose -out your garbage can and recycling bins

-Remove screens and wash with a soapy sponge and water

-Wash the outside of your windows before replacing your window screens

-Begin perennial garden clean up!

Is there Stabilization in our Future?

We asked last month “Is this a Blip or Flip?” Well, the answer is: it’s looking like a Blip. Interest rates went into overdrive again and buyer applications for new mortgages visited a low not seen since 1995. The voracious activity we saw in January and early February has come to a halt thanks to interest rates going from high 5’s to 7% in 3 weeks’ time. Buyers and Sellers are looking for stability in economic data and we think that stability is in volatility, at least in terms of interest rates for the near term. Rates will fluctuate pending the inflation data that comes out monthly until that number begins to trend downward, month over month. Until we see that trend take hold the Denver real estate market will remain a little choppy. We will have months with more inventory and less buyers and months with more buyers with less inventory. Once we enter the late spring early summer selling season the hope is that the Market will begin to stabilize further because interest rates are predicted to come back down and stay there.

Home Prices Stabilizing?

Even with all this movement, we are seeing the housing market stabilize somewhat. Year over year home prices are starting to show some depreciation in certain areas, but month over month we are seeing prices moving higher (minimally) as well. Interest Rates are keeping prices from rocketing upward while the inventory shortage is keeping them from rocketing downward offering homeowners, sellers, and buyers some stability in the market. What we see in the actual market is that homes in great shape (ready for market) and in decent locations are selling quicker and for more money. Buyers are no longer tolerant at all of properties that are not prepared well for the market, taken care of, or priced inaccurately. Period.

February 2023 Housing Market Update

Active Inventory: 3,778 (↓) 8.30%

Closed Sales: 2,661 (↑) 22.51%

Average Closed Price: $657,921 (↑) 5.23%

Days on Market: 48 (↑) 4.35%

(Stats reflected here are MoM January to February)

The numbers for last month are not a surprise to anyone in the market. Sellers, buyers, lenders, and agents were all in agreement that something had changed from October, November and December. Clearly that reprieve came from a drop in interest rates that stuck around for a couple of months. We want to add that the luxury market was moving extremely fast with many competitive offers. There did not seem to be a stronger area over another for those price points. We did see luxury inventory that had been sitting for months (more than several) disappear in a matter of weeks.

The See-Saw will Continue

The statistics for March when they come out will show a slower pace for sure at most price points. Even those buyer’s that have been approved are now struggling with lower inventory and higher rates again and have slowed their roll when submitting offers. The Real Estate Market see-saw will bring good and bad news over the next couple of months. We will keep working our way through it and keep you up to date on what we are experiencing day to day. What we do know is that predictions will be shot down, headlines will be sensationalized, and people will still need housing.

If you know anyone that is thinking of buying or selling a home, please keep us in mind. We love referrals and you have our word we will take great care and provide great service to them as we have to you!

Data represents Attached and Detached Homes in the 7 county metro area.

We would like to thank DMAR for information and statistics used in crafting this article.

February 2023 Closed Homes

February 2023 Closed Homes

It was our pleasure to help these First Time Home Buyers find and purchase this beautiful home. They scooped it up for less than ask and got some cash back at closing to help with the move! The Walters Group is always happy to help you Buy, Sell or Invest in Real Estate~ please reach today to chat!

Denver Happenings March 2023

In 1973, singer-songwriter Harry Nilsson released an album of standards from the Great American Songbook, an adventurous and unprecedented move for someone at the height of their powers in the rock era. The album, A Little Touch of Schmilsson in the Night, takes listeners on a narrative arc through infatuation, courting, marriage, separation, and the inevitable slide into old age. This March in celebration of its 50th Anniversary, Denver singer and songwriter Nathaniel Rateliff breathes new life into this classic album alongside the Colorado Symphony, blending his folk, Americana, and vintage rhythm & blues influences with Nilsson’s classic tribute to the Golden Age of American music.

Come out to Wash Park at Franklin and Mississippi and run, plunge or do both in support of Colorado’s Special Olympics Athletes! By signing up you get you get a either a t-shirt or an exclusive runner’s only gift! Make sure that if you want to plunge you sign up for both!

Enjoy this ten-day culinary celebration where hundreds of Denver restaurants come together providing multi-course menus for a set price! Best week ever!

Back again for its 60th year, come see the floats, dancing, live bands and charities!

Engage with art, explore onsite activities, and experience exhibitions on view all while enjoying free admission! Advance ticket reservations are encouraged.

At the Denver March Powwow, there are more than 170 booths selling a variety of Native American artworks and products. Browse jewelry and blankets, pottery and beadwork from some of the nation’s most skilled Indian craftsman. Try Native American foods such as fry bread and Indian tacos, or buy an authentic Cheyenne arrow or a Sioux Tomahawk. The Denver March Powwow is a welcoming glimpse into a fascinating part of North American culture.

Frozen Dead Guy Days, one of Colorado’s most beloved annual events for more than 20 years, is kicking off a new chapter in Estes Park. Taking place over St. Patrick’s Day weekend on March 17-19, 2023, the reborn Frozen Dead Guy Days will feature live music and entertainment all weekend long, and will be held at the Estes Park Events Complex and The Stanley Hotel, with satellite events occurring around town. Festival goers can expect the weird and wonderful happenings from years past, including coffin races and a polar plunge, as well as plenty of new and elevated Estes twists, like a frostbite fashion show, roaming freak show acts, a Bands and Bloodys Sunday Brunch and more.

**Click on the Name of the Event for More Information**

Is this a “Blip” or a “Flip” for the Denver Housing Market?

January 23 Housing Market Update

It has been a whiplash kind of month in the Denver Metro Real Estate market. We went from homes sitting for 45 plus days since June of 2022 to stale listings getting re-listed and going Under Contract with multiple offers again. In September, October, and November of 2022 Buyers were asking and getting cash at closing to buy down rates, multiple inspection items repaired and the luxury of being the only buyer coming forward with an offer on a home. This trend continued through December of 2022 but after the first weekend in January the race was on for Buyers. The question all of us are asking on behalf of our buyers and sellers is, “Is this the beginning of a trend or just a seasonal collapse of new inventory combined with interest rates settling in and strong pent up buyer demand?”

I hate to say it again, but inventory continues to be the bear in the woods for our Market. January saw the smallest number of new listings (2,858) ever added in that month, the previous record was set in 2022 (3,3485). Active inventory at the end of January 2023 was 13% lower landing at 4,120 than the month before. Are we switching our hot selling season from the Spring and Summer to Fall and Winter? Is Q1 going to be the new hot time to sell your home? I don’t think we can come to that conclusion yet, but it might be worth looking at if it happens next year or if the market continues its cha-cha-cha through March of 2023. With almost 40% of all homes in Colorado owned out right and 86% of all mortgages held have a 5% or lower interest rate it is hard to see the inventory belt loosening soon.

January 2023 Insights:

(Stats Reflected here are MoM December to January)

Active Inventory: 4,120 down 13.9%

Closed Sales: 2,041 down 29.3% (This appears to us as an inventory crunch)

Average Close Price: $626, 311 down 1.49% (even though we are down this price is also a record high for the Month of January)

Days On Market: 46 up 6.98%

The first quarter of 2023 will have a cloud over head when compared to Q1 of 2022. We ended the year with median price growth of 12% all gained in the Q1 of 22. In January we saw a decline of price growth from December to January of 3.33%. We are guessing the pressure on sellers to sell their homes that had been sitting for too long brought about aggressive price reductions to get their homes finally sold. We will see this number climb or flatten when February stats come out in March. If inventory pops over the next couple of months to meet Buyer demand, you will see home prices soften. If those new listings don’t start appearing and interest rates come down further, we will see pricing stabilize and maybe start growing again.

The Fed raised the Fed rate again by .25% on February 1st to 4.75%. He mentioned that we are seeing the pace of inflation slow but that we are not out of the woods yet. He still repeats that we need more evidence that the pace will continue to slow before he lifts his foot off the gas in terms of rate hikes. What differed this time was that if he saw the inflation rate dropping too quickly it may influence the feds to change course and possibly encourage them either slow or stop rate hikes. The other market segment that gives the Fed pause is the job market. That market continues to come in with historical numbers month over month. Wages are still increasing and those jobs that are being lost are being replaced almost immediately with new higher paying options.

In conclusion the market had some wins this past month not only locally but nationally. To say we needed some positive news about the housing market is an understatement. We are hopeful that we will see a more balanced market over the next couple of months. Sellers will get to sell at a reasonable rate in a more reasonable amount of time and Buyers will get to see and bid on homes without unreasonable pressures.

If you know anyone that is thinking of buying or selling a home, please keep us in mind. We love referrals and you have our word we will take great care and provide great service to them as we have to you!

We would like to thank DMAR for information and statistics used in crafting this article

Denver Happenings in November

Denver Film Festival: November 2-13

The largest film festival in the Rocky Mountain region brings international cinema, filmmakers, virtual reality, immersive experiences and creative conversations to Colorado. Events will take place all over town.

Denver Arts Week: November 4-12

Celebrate The Mile High City’s arts and culture scene with hundreds of events around the city. Explore vibrant art districts, check out museum exhibitions and outdoor sculptures, indulge in the performing arts, be inspired at film and literary events, and even buy some art of your own!

Wine in the Pines: November 5

The Ability Connection Colorado, a non-profit organization that offers an assortment of opportunities for people with disabilities, sponsors this annual wine and food pairing. This year’s Wine In The Pines at Keystone Ranch and Keystone Conference Center

Denver Veterans Day Run: November 12

Back for its 14th year, the Denver Veterans Day Run, hosted by the Colorado Veterans Project, is both an in-person and virtual 5k and 10k event that directly benefits Colorado Vets. Registration varies for civilian and veteran runners and all results can be viewed on an online leaderboard.

Polar Express Train Ride: November 11- December

Ride to the North Pole aboard vintage coaches, pulled by an authentic, coal-fired steam locomotive. Visit with Santa and delight as he hands you “The First Gift of Christmas!” Always a sell-out, you’ll want to book early.

Denver Fashion Week: November 12-20

One of America’s fastest-growing fashion platforms is back again for fall 2022. Collections from local, national and international designers will range from streetwear, activewear, lifestyle, kids and sustainability to high fashion.

National Parks Free Day: November 11

Come experience the national parks! On five days in 2022, all National Park Service sites that charge an entrance fee will offer free admission to everyone.

Turkey Trot: November 24

The Mile High United Way Turkey Trot has been a Thanksgiving tradition since 1973, drawing nearly 9,000 people to Washington Park each year for a four-mile run/walk and community celebration. By participating in the Turkey Trot, you are joining Denver’s greatest Thanksgiving tradition AND giving back to your community!

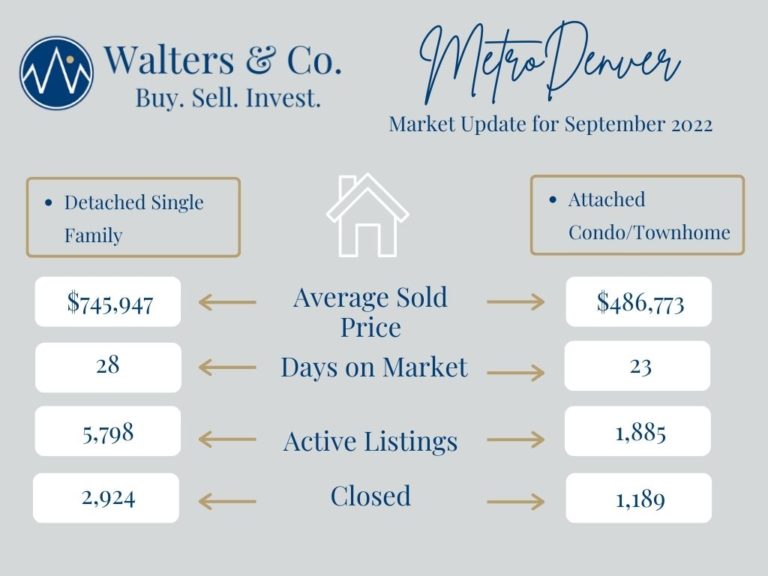

September Denver Market Update

The Cooling Continues is our headline for the month! Mortgage rates landing around 7% after the Fed meeting really sealed the deal on a slowing of the housing market. What we are seeing in our local market is a more balanced housing market right now and even more balance coming our way. We have been without balance for an extended period and those of us in the housing business know that the only way for win-win transactions for both Buyers and Sellers is a balanced market. To get there, we are going to need more inventory and while that is beginning to come forward, we will need more.

September Insights

Active Inventory:

- Saw a MoM increase of almost 11% landing at 7,683 Units for sale

- Inventory typically drops as we head into the winter months

Average Home Prices

- Increased 2.2% even though actual sales were down

- We are still predicting that home values will be up for 2022 by years end

Days on Market

- Is up nearly 37% MoM. We are now at 26 days on average to move

- This tells the story of Sellers not quite realigned to new home prices

While our inventory numbers are up, we are still below by 26% where we were at during the same period in 2019. The average homes for sale at the end of the month since 1985 is 15,663 for September. Interestingly last year’s inventory increase (10.86%) from August to September matched these years (10.72%) almost exactly. What that means? Not sure.

The rental market is still strong, especially for properties that are well kept and updated. There is a cooling nationally in rent increases but getting tenants in place has not slowed down in the Denver Market.

We think “Not sure” is where we will end this month’s commentary. There is so much happening in the world, nationally and locally it is hard to pin down exactly where we are going. In speaking with a lender the other day, he said, “economic theory vs. supply and demand” is what we are waiting for to work their way out. Which one wins we will have to wait and see. You can be assured we are watching all the factors very closely and will keep sharing everything we learn right here!

If you would like to expand on this conversation, please reach out we are happy to answer questions and have a discussion anytime.

Village Invest Charity:

Hurricane Ian

“With our partners, we have provided refuge for thousands of people in our shelters. Most of our shelter residents are about 70 years of age or older; many have complex health challenges and disabilities; and they have lost everything they owned because of Hurricane Ian.

With the help of Southern Baptist Disaster Relief, four mobile kitchens are now cooking tens of thousands of hot meals each day. Nearly 120 Red Cross emergency response vehicles are on the roads delivering these meals and relief supplies to people struggling in the hardest hit areas.

Red Cross shelters and disaster aid stations — at 20 different locations — are open where people can either stay or get food, relief supplies and other assistance. Trained volunteers are also providing health and mental health support to families who have suffered unimaginable loss. This includes help coping with new challenges, managing medical conditions, caring for wounds or injuries, and replacing prescription medications or other critical medical equipment like canes and wheelchairs.

More than 1,600 Red Crossers from all 50 states and the District of Columbia are supporting relief efforts.

With our partners, we have provided more than 601,000 meals and snacks, and some 98,000 comfort kits and other relief items like cleaning supplies.

Red Cross teams are also starting to compile more detailed residential assessments including how many homes have been affected and the extent of that damage. This critical information will be used to make plans for what support families may need in the coming weeks and months.”

How you can help:

Denver Happenings in October

Did someone say OCTOBER?! How in the world did that get here so fast? To be honest, not sure that we care either way because that means all things fall are here! Check out what’s happening in Denver for the month of October. Get ready to get spooky!

Prairie Harvest Fest: October 1, 2022

Back for a third year, this FREE fan-favorite event features all things fall including hay rides, games, pumpkin patch and more! Headlined by Denver’s favorite band — Funkiphino! Fun starts at 10am and runs ’til 3pm! Head over to Painted Prairie for some family-friendly fall fun y’all!

Great American Beer Festival: October 6-8, 2022

This one speaks for itself and all of Denver looks forward to it every year! Grab your tickets by clicking the link above!

Pumpkin Festival: October 7-9, 2022

Come get your pumpkins! Ticket prices include access to the 10-acre pumpkin patch and family friendly activities. Pumpkin prices will vary by pumpkin size but the average price is $8. Bring a wagon if you love pumpkins and need more than you can carry! If you have little ones that won’t be happy here for more than a few minutes, Day Care is also available!

Spooky Streets: October 21, 2022

Check out the annual Spooky Streets event! Free fall fun for the entire family! Enjoy an entertainment stage, face painting, balloon artists, dance party, parade of costumes and MORE!

Candy Crawl: October 9, 2022

Head over to the Shops at Northfield for another FREE annual family-friendly, Halloween event, CANDY CRAWL. Enjoy trick or treating participating retailers, hay rides, crafts, thriller dancers, giveaways, contests, and more!

Ghosts in the Gardens: October 13-29, 2022

Tour the Gardens after dark and hear spine-tingling stories of our haunted history. Conjure your courage and capture your fear as you walk our dimly lit paths after hours and dare to have your own ghostly encounter, at Denver Botanic Gardens.

Glow at the Gardens: October 18-23, 2022

Wander through a spooky, illuminated landscape as the Gardens dresses up for Halloween. Using all real pumpkins harvested from local farms, our pumpkin artists push the boundaries of traditional pumpkin carving to create larger-than-life sculptures and dense displays of jack-o’-lanterns, with grins and grimaces fit for the season.

Adulting with the Animals: October 27, 2022

(Monster Masquerade)

Explore the Zoo with your kid free crew! Ready to explore the Zoo with your grown-up—or at the very least, kid-free crew? Adulting with the Animals is BACK, with all-new offerings on select Thursdays and Sundays through the fall! Celebrate spooky season with creepy-crawly Animal Ambassadors, cool character photo ops, a costume contest and a live DJ!

Despite a Cool-Off, Denver Metro is still favoring Homes Priced Right & in Good Condition

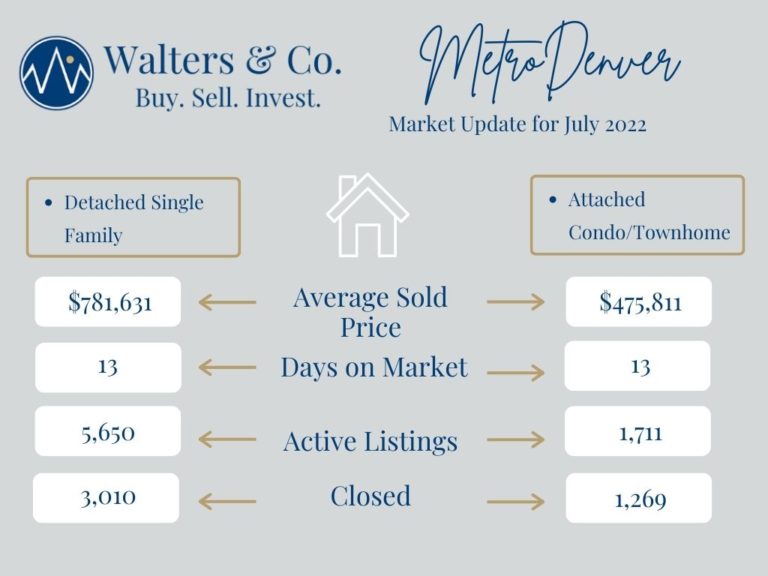

July Housing Update

DMAR came to the table this month with some good data points about our current housing market, in addition to sharing their information we are also going to share what we are seeing in real time. What we noticed last weekend was that the drop-in interest rates did indeed bring more buyers out hunting, but it also saw new listings come to the market still overpriced. The Buyers we were working with were so perplexed by some of the homes they saw regarding condition and pricing and just walked away or refused to see homes that were not it range with what recently sold or showed poorly in photographs. For Sellers in a shifting or shifted market pricing and condition are everything they are your most powerful tools and our advice to you is to use them.

- Home values saw a 3.33% decline last month but year over year they are still up over 11%.

- Days on market moved to 13 a 30% increase

- Inventory is up again by 22% month over month over 80$ from a year ago (still not where it needs to be)

The average American is 30 years old now and 69% of people aged 24-40 said they prefer home ownership over renting and sacrifice a lot to own a home. These stats suggest to economists that the housing slowdown will remain just that, a slowdown, not a bursting or bursted housing bubble.

5280 Magazine came out with their top neighborhood list. They examined 78 Denver communities their valuation consisted of:

Home values, schools’ quality, safety, cultural offerings, nearby shops, open space etc.

No surprises here: Washington Park, Platt Park, Wellshire, Belcaro and City Park.

We are happy to expand on any of this information anytime. We have always and still grow our business through referrals, we hope you will keep us in mind if you know anyone looking to buy, sell or invest!

Village Invest Charity:

The Park People Denver

The Park People was created in 1969 by a small group of park enthusiasts who banded together to raise private funds to support Denver’s extensive parks and recreation system. They are a separate entity from Denver’s Department of Parks and Recreation, but have worked in close partnership with the department since their founding.

In the 50+-year history they have been around, The Park People have infused many millions of dollars into Denver’s parks through the restoration of existing park infrastructure, such as fountains and historic park buildings, and through new construction, such as playgrounds and recreation facilities.

The Park People is a private 501(c)(3) nonprofit organization working with communities to plant trees and improve parks for a healthy, resilient future.

They are passionate about our local parks, our city trees, and other shared community resources.

“We believe that healthy parks help grow healthy communities. We believe that our community forest not only makes our neighborhoods beautiful places to live, but provides critical functions to the health, well-being, and sustainability of urban life.”

To check out more about how The Park People are helping our community, click here! To join us in their mission this month, donate by clicking on the button below!

10 Years of Housing Crash Stories Explained

After watching Chris Magnotta’s video about this very subject we thought it would be interesting to include it in this week’s newsletter. The housing market “crash” has been talked about every year since 2007/2008 when it really took a nosedive (also the year we started our fist real estate company). Ever since then it has been predicted to crash because of some indicator or another every year. Most of us believe that a recession is coming our way in 2023, how wide or deep that takes our country remains to be seen. A recession influences the housing market differently and may wind up driving rates back down and bringing more buyer’s back to the market. While housing inventory is currently on the rise, we are still at about 1.3 months of inventory (up from a very scary 10 days of inventory at one point) to supply the Denver Metro Area. Our inventory issue is not only caused by a decade of under building in our community but many other influences as well. A recent phenom is something called Rate Lock. Rate Lock happens when many home loans exist with a very low interest rate. 75% of homes in the Denver Metro Area have a 30-year fixed product locked in below 4%. This causes people to stay put longer than they normally would have. We could go on and on about inventory pressures and supply and demand but instead just know that Real Estate over time is still a safe bet. Enjoy our timeline below!

2012– Shadow Inventory – the housing crisis had left a lot of homes in foreclosure and the talking heads said repeatedly that this would cause another housing crash because we had so much of it. That did not happen

2013– Rising Rates – Rates were on the rise in 2013 and had gone up quite a bit and this was going to bring on another housing crash. That did not happen.

2014– Mortgage Applications were Down- This is happening now, by the way, but in 2014 they were down to almost historic lows. The heads said the housing crash is coming. That did not happen.

2015– The Silver Tsunami – Baby Boomers were predicted to sell all their homes at prices that could not be afforded by the next generation and that would cause our next housing crash. That did not happen.

2016 – The Manufacturing Recession – Yes that did happen, and the stock market sold off quite a bit as well that year. This was indeed going to get our housing market. That did not happen.

2017– Home Prices Peaked – (we thought they peaked) Home prices were finally back to where they left off in 2007 and we had reached our Peak. Affordability was coming for us. That did not happen

2018 – Mortgage Rates go over 5% – This was going to cause people to not buy a single house and bring on another housing crash. Not only would people purchasing their own homes bail on the housing market but so would investors. That did not happen.

2019– Housing Inventory Rising- We must admit that we even thought that inventory would go way higher that year, it was on its way in the Fall and then came to a screeching halt. Some markets began to see a slight decline in appreciation as well in 2019 and the heads said, “We Are Here”, the crash is upon us. That did not happen, and we are guessing if you purchased a home or investment property in 2019 you’re doing ok.

2020– Covid – I don’t think I need to expand on this one. This “market crash” did not happen.

2021– Forbearance Crisis – I know you all remember this it was a headline in every paper, on every blog title and every video title about housing. This was going to deliver the long-awaited housing crash. Appreciation took hold and combined with a strong job market and that did not happen.

2022– Here we are again and now we are seeing higher mortgage rates, lower mortgage applications, higher inventory, and a looming recession. All of this and rising rents will bring on our next housing crash. I think what we can say for sure is that the housing market is shifting as is everything else that surrounds us. We wish we could say for certain how long we will be here, but we can’t. What we can do is pay attention to what is going on and be here for our clients with real information not just catchy headlines to scare them.

Denver Market Update

Buyers who waited for less competition, more contract power and lower prices have paid in terms of higher interest rates and Sellers that waited to list their home for sale are paying with higher days on market, no bidding wars, more contract contingencies and lower prices. While this all sounds daunting all it really means is that we are pointing towards a more balanced market. Which in theory could be sustained longer than these extreme conditions for buyers or sellers. Our company has professionals that have weathered both extremes and we all crave the more balanced atmosphere as it promotes happier clients and more opportunity for everyone.

Good news for Buyers and Sellers; Sellers homes are still selling above ask in a lot of cases and Buyers have more options and are competing against less people.

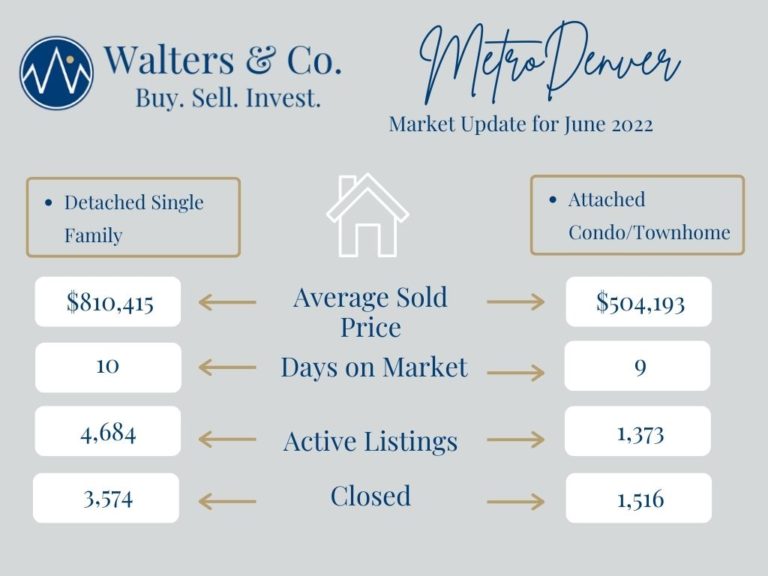

The stats below are Month over Month: from May to June of 2022.

#1 Homes Available up 65% MOM

#2 Closed Sales down 12.42% MOM

#3 Average Closed Price up .73% MOM

#4 Average Days on Market up 11.11% (4 days to 11 days)

Homes with a price drop came in at 40% of all homes listed for sale last month. June’s big lesson for Sellers is to price your home aggressively – not at what your neighbor sold their home for 2 months ago. The lesson for Buyers is to get your financing in place, look at all the loan products available, there are many, and don’t be afraid of dipping those toes back in the market, opportunity exists!

**And for those of you who think the buyers are going to save the day…they are seeing a mass exodus of VC money. Where they once were offering way over ask for homes they have begun to offer way below market value now in hopes of scooping from panicked Sellers**

If you think Walters & Co. can be helpful please don’t hesitate to Contact Us!

Thanks DMAR for the information/stats